Executive Summary

As experienced Northern Beaches Buyers Agents, we have witnessed the Northern Beaches market move from volatility to stability in 2025, with measured growth and renewed buyer confidence. Median house prices are up around 7–9% year-to-date (although this varies considerably by Suburb), driven by chronic stock shortages, lifestyle appeal, and resilient demand. Units are also rising steadily, helped by strong rental yields and limited new supply.

Key Highlights:

Houses

Region-wide median $2.1M; growth strongest in Dee Why (+13% YoY) and Palm Beach’s prestige rebound (+37% from 2024 trough). Manly remains stable at the top end.

Units

Median ~$995K; Dee Why (+9% YoY) and Avalon (+4.5% YoY) lead growth, with yields often 3–4%, outpacing houses.

Market Dynamics

Stock remains scarce, competition is high, and buyers are discerning—overpriced or poor-quality homes can still stall.

Outlook

Forecast 2–4% further price growth in 2025, with sustained rental demand supporting the unit market.

Overall, the market is maturing—growth without the boom-time frenzy.

A Turning Point in 2025

The Northern Beaches property market has regained its stride in 2025, moving past the volatility of the pandemic boom and correction. In the first half of the year alone, the median house price in the region climbed about 7.3%, reflecting a broad return of buyer confidence. With interest rates appearing to have peaked and even a rate cut in February improving sentiment, buyers are back in force – albeit with a more measured approach than during the 2021 frenzy. Importantly, the market fundamentals remain solid: supply is chronically tight, lifestyle appeal is second to none, and well-heeled buyers are still eager to secure a slice of this coastal enclave. The result is a market that isn’t “overheated” or crashing – it’s maturing, with moderate growth replacing the rollercoaster swings of recent years. In short, 2025 has marked a confident but realistic turning point for Northern Beaches real estate.

House Market: Strong Gains Amid Tight Supply

Houses Lead the Recovery

House values across the Northern Beaches have risen noticeably in 2025, recovering much of the ground lost in the previous correction. The median house price region-wide is around $2.1 million (vs about $1.56M Sydney-wide) , and it’s edging toward a new record. Year-to-date, Northern Beaches house prices are up roughly 8-9%, and year-on-year, many suburbs have seen double-digit growth.

For example, Dee Why’s median house price has surged to about $2.70M – up 13.2% year-on-year, far outpacing the 4% Sydney-wide growth. Even the prestige tier is rebounding: Palm Beach’s median house price ($5.36M) jumped ~37% from its 2024 trough by mid-2025, nearly back to its pandemic boom peak. Such gains underscore how limited supply and renewed demand are boosting values – there simply aren’t enough quality houses for all the buyers who want in.

Not Uniform Across the Board

That said, the growth is uneven. Some ultra-premium pockets like Manly (median house in the mid-$4 millions) have been relatively flat over the past year. Manly held its value better during the downturn (it “caught its breath” after earlier booms), so its prices are only now stabilising rather than jumping. In contrast, family-oriented suburbs and value pockets are seeing the strongest competition and price rises. Auction clearance rates reflect this steady demand – Northern Beaches auctions have been clearing around 70%+ of stock in winter (roughly on par with the Sydney average).

Well-presented houses in popular price brackets often attract multiple bidders, while overpriced prestige listings can still require patience. On average, a Northern Beaches house spends about 4–8 weeks on the market, but this ranges widely: desirable family homes in mid-tier suburbs can sell in a few weeks, whereas $5M+ luxury homes (e.g. Palm Beach) might take months to find the right buyer. Overall, the house market is firmly in recovery – prices are trending up at a healthy single-digit pace, underpinned by scarce supply and buyers’ enduring love for the Beaches lifestyle.

Unit Market: Steady Growth and Improving Yields

Units Playing Catch-Up

The unit apartment segment is also on the rise, albeit more gradually. Northern Beaches units have historically lagged behind houses in capital growth, but 2025 finds them in demand thanks to relative affordability and skyrocketing rents. The median unit price across the region is roughly $995,000, and unit values have crept up by mid-single digits year-to-date. Many suburbs are seeing solid unit price growth – for instance, Avalon Beach units are up about 4.5% year-on-year, and Dee Why units jumped ~7–10% in the last 12 months. First-home buyers and investors, priced out of $2M+ houses, are actively targeting units in beachside hubs and transit-friendly areas. This demand is reflected in quick sales: a typical unit in a hotspot like Dee Why spends just 3 weeks on market (≈23 days) on average – a turnover even faster than houses in many cases.

Rental Boom = Higher Yields

A key story for units is the exceptionally tight rental market driving investor interest. Vacancy rates on the Northern Beaches are hovering around record lows (often under 2%), leading to surging rents and improving yields. In Manly and Dee Why – two of the most sought-after rental locations – weekly rents are hitting record levels. As a result, gross rental yields for units are now around 3–4% in many suburbs. For example, a median Dee Why unit (~$975K) rents for about $750/week, yielding ~3.9%. That’s significantly higher cash flow than houses (where yields are closer to 2–2.5% in this region).

This rental upswing, combined with lower entry prices, is attracting investors back to the unit market. It’s also giving would-be homeowners more reason to consider apartments as a foothold into the Northern Beaches. Units remain about half the price of houses here on average, offering a (relatively) budget-friendly way to enjoy the lifestyle. With demand rising and new apartment construction limited, the unit market is quietly strengthening alongside houses – a trend of “steady growth” rather than explosive gains.

Suburb Spotlight: Manly – Steady at the Peak

Manly is the crown jewel of the Northern Beaches, and its property market reflects a mature equilibrium. The median house price in Manly sits around $4.5 million, which is roughly unchanged versus a year ago (CoreLogic data shows a few per cent rise). In truth, Manly’s prices never fell much during the recent correction – it remains a blue-chip enclave that had its big boom earlier. Buyer demand is consistent but price-sensitive at this lofty end. Houses here average about 50–60 days on market, longer than in cheaper suburbs, as buyers take their time for multimillion-dollar decisions.

On the unit side, Manly’s median apartment price is about $1.6–1.7 million, with slight annual growth (~+2%). Manly units also move a bit slower than the frenzy elsewhere (around 5–6 weeks on market), given many are high-end downsizer or investor purchases. Importantly, rental yields in Manly are quite low – about 2.1% for houses and 3.0% for units. This underscores that Manly is a capital growth play, driven by owner-occupiers and lifestyle buyers more than investors seeking yield.

The radically honest take? Manly’s market isn’t “cheap” by any stretch. Buyers here pay a premium for the beachfront lifestyle and ferry commute, and they aren’t seeing bargain prices even post-correction. However, the upside is stability – Manly “tells it like it is,” holding value through cycles and consistently ranking among Sydney’s most desirable addresses.

Suburb Spotlight: Palm Beach – Prestige Rebound

At the tip of the peninsula, Palm Beach represents the prestige, holiday-home segment of the Northern Beaches – and it’s had a rollercoaster ride. After a sharp drop in 2022–23, Palm Beach has roared back in the past year. The median house price is now about $5.3 million, roughly a 3% annual increase from mid-2024 (and up dramatically from its low point earlier in 2024). With only ~28 house sales in the past year, one or two big sales can swing the median – and indeed, a record Whale Beach sale early in 2025 helped lift values.

The reality is, Palm Beach demand never disappeared; it just went dormant during the interest rate hikes. Now, buyers have returned and reset their expectations, leading to recent sales that pushed the median back near its previous peak. Properties here do take time to sell (avg ~140 days) , as the buyer pool is small and discerning. But they do sell. Notably, rental yields are the lowest on the Beaches (~1.9% for houses) – this is not a market for yield hunters, but for affluent buyers seeking luxury retreats.

There are relatively few apartments (just 2 unit sales in 12 months), but those that exist have a median around $1.1M and saw double-digit price growth off a low base. Palm Beach’s rebound sends a clear message: the top end of the Northern Beaches market has re-found its footing. After the “froth” came off the top, cashed-up buyers stepped back in, confirming that the allure of a Palm Beach weekender – from surf to sunset – is as strong as ever.

Suburb Spotlight: Dee Why – Affordable Growth Hotspot

Dee Why has emerged as one of the Northern Beaches’ hottest markets in 2025. This vibrant beachside suburb offers a more attainable price point than Manly, and buyers have taken notice. The median house price in Dee Why is now roughly $2.85 million, after soaring about 11–13% in the past year . In fact, Domain’s data showed Dee Why leading Sydney’s growth charts, with annual house price growth triple the city average. Even with that jump, it’s still cheaper than many neighbouring suburbs, so young families and upsizers are competing fiercely for the limited houses available. As a result, houses here sell in just around 5 weeks on average (36 days) – a very brisk pace – often after attracting multiple offers.

On the unit side, median unit prices are around $950k–$1.05M depending on size, with solid growth of ~8–10% over the year. Units move even faster than houses, typically under 24 days on market, reflecting high demand from first-home buyers and investors. Rental demand in Dee Why is through the roof – it’s consistently listed among the top rental suburbs on the Beaches. That translates into strong yields: ~2.5% for houses, nearly 4% for units, well above the region’s average.

In radically honest terms, Dee Why currently offers one of the best “value propositions” on the Northern Beaches: a coveted beach lifestyle (cafés, B-Line buses, shopping, and of course the surf) at a relative discount to Manly, plus the prospect of further growth as buyers seek affordability. The challenge is simply finding something to buy – stock is tight, and good listings get snapped up quickly.

Suburb Spotlight: Avalon Beach – Lifestyle Appeal, Stable Prices

Up in the northern reaches, Avalon Beach provides a more laid-back, village atmosphere – and its market in 2025 is stable and balanced. After the wild swings of 2020–2021 (when Avalon’s house prices jumped over 30%) and a subsequent dip, values have levelled off. The median house price in Avalon is about $2.88 million, essentially flat (0% growth) year-on-year. In other words, Avalon houses have held their value at the high-$2M level reached post-boom, but they haven’t pushed much higher lately.

Buyers remain active – 145 houses sold in the past year – yet they are price-conscious, and we’re seeing a bit more negotiation. The typical Avalon house spends around 60+ days on the market, indicating a less frenzied pace than suburbs closer to the CBD. For units, the median is around $1.15 million, with a modest ~4–5% annual price rise. Units take ~45 days to sell on average, still a reasonably quick market. Yields in Avalon (≈2.5% houses, 3.3% units) are slightly above Manly’s, thanks to strong rents achieved in this lifestyle locale.

The radically honest view on Avalon: it’s a beloved community (think surf culture, cafes, and a tight-knit feel) that saw early, outsized gains during the pandemic boom, and now the market is catching its breath. There may be opportunities here for buyers, as prices have plateaued while other suburbs are now rising – effectively making Avalon comparatively cheaper than a year ago in relative terms. For those seeking a sea-change vibe and willing to commute a bit further, Avalon remains a highly desirable choice, and its long-term trajectory still points upward given the perpetual demand for coastal lifestyle and the finite supply of homes in this idyllic pocket.

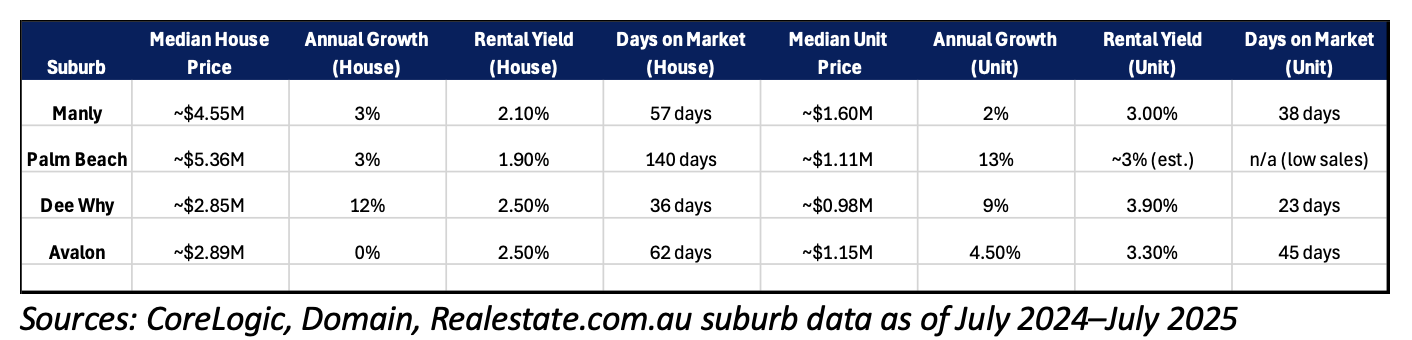

Comparing Key Suburbs – Prices, Yields, and Days on Market

To put the above insights in perspective, the table below compares current median prices, annual price growth, rental yields, and days on market for houses and units in the four spotlighted suburbs:

As shown, Manly and Palm Beach command the highest prices but have lower growth and yields, while Dee Why and Avalon offer more affordability and in 2025 saw stronger percentage gains. Dee Why in particular stands out for its rapid sales and investor-friendly yields, whereas Palm Beach’s tiny market requires patience (140 days on market on average for a house!) . These metrics paint a clear picture: the Northern Beaches isn’t one monolithic market, but a collection of micro-markets – each with its own tempo. Smart buyers and investors are studying these details to find value pockets and decide where their money is best spent.

Challenges and Opportunities: A Radically Honest View

Chronic Supply Shortage

No market update is complete without addressing the challenges alongside the good news. In the spirit of radical transparency, it must be said that the Northern Beaches property scene faces a chronic supply shortage that isn’t going away. Geography and strict planning controls mean new housing is scant, so we have a classic “too many buyers, not enough homes” dynamic. This pushes prices up but also frustrates would-be buyers – stock levels on the Beaches are near historic lows in many price segments.

Buyer Competition

Buyers are encountering fierce competition for quality listings, and some are hesitant or fatigued after missing out at auctions. Higher interest rates over the past year have also reduced borrowing capacity, so budget-conscious house-hunters may feel squeezed. Additionally, as prices climb, affordability is a real concern: a $2–3M entry ticket for a family house is steep, even for dual-income professionals. This can cause some buyers to sit on the sidelines, hoping for a dip that so far hasn’t materialised.

Outlook for Sellers

On the seller side, the challenge is that today’s buyers are well informed and won’t overpay for overpriced, mediocre properties – if a home isn’t A-grade (or isn’t priced right), it can still languish unsold. We see this in the longer days on market for the less compelling listings. In short, the Northern Beaches market, while healthy, is not without friction: limited choices, cautious financing, and discerning demand mean it’s no free-for-all.

That said, opportunities abound for those who know where to look. One bright spot is the emergence of “value pockets” – suburbs that offer Northern Beaches lifestyle without the top-tier price. For instance, areas like Wheeler Heights (median house ~$2.25M) or Manly Vale (~$3.09M) remain comparatively affordable and have strong upside potential. These pockets are attracting savvy buyers who recognise they could be “next in line” for growth.

Similarly, units present an opportunity: with yields nearing 4% in places like Dee Why, an investor can actually get decent cash flow and the prospect of capital gains as more renters turn into buyers. For upgrader families, the current market offers a window where they can sell in a rising market and buy their next home before prices run away – especially if they move quickly in suburbs like Avalon or Frenchs Forest where price growth has been more modest recently.

Rental Market

Another opportunity is the rental market’s strength: owners have the option to lease out properties at record rents (the Beaches remain a highly coveted rental area), turning their homes into high-demand investments if they aren’t ready to sell.

In essence, while the Northern Beaches market has its pain points (low stock, high prices), it also has plenty of promise. The key is cutting through the hype and looking at the real data – something we’ve aimed to do in this update. By staying transparent about both the hurdles and the opportunities, buyers and sellers can make better decisions. This aligns with our core belief: tell it like it is, no sugar-coating, so our clients can act with eyes wide open.

Outlook: Late-2025 Forecast and Final Thoughts

Sustainable Growth Outlook

What does the remainder of 2025 hold for the Northern Beaches? Barring any major economic shock, the outlook is cautiously optimistic. The market appears to be on a sustainable growth trajectory rather than a speculative boom. Interest rates seem to have plateaued and may even ease further into 2026 if inflation stays controlled, which would give buyers more confidence and borrowing power.

Resilient Buyer Demand

Buyer demand remains resilient – families, downsizers, and even some investors are actively in the mix – and this demand is met by persistent scarcity of listings. That suggests prices are likely to continue their gentle rise. Our realistic forecast: home values on the Northern Beaches will likely tick up another ~2–4% over the rest of 2025. This would put total calendar-year growth in roughly the mid-single digits, in line with many analysts’ expectations for Sydney. In other words, a steady climb, not a spike. We anticipate house prices to end the year 2–4% higher than they are now, and unit prices to also gain a few more percent, riding on the strong rental market.

Remain Grounded and Be Well Informed

It’s important to note this forecast isn’t about hype – it’s grounded in the momentum we’re seeing on the ground today. Could there be speed bumps? Absolutely. Economic news, election-year policies, or a surge in listings could temper growth. But as of August 1, 2025, the trend is upward, and the Northern Beaches market has the wind at its back. For buyers, this means the window of slightly calmer conditions may close as we move into spring; acting sooner rather than later could save you money as prices creep up. For homeowners, it means your asset is likely to keep appreciating at a modest pace – good news if you’re considering refinancing or leveraging equity. For everyone involved, our advice is to remain grounded and informed: this market rewards those who do their homework and stay patient, but also those who move decisively when opportunity knocks.

Conclusion

The Northern Beaches property market as of August 2025 is balanced on a positive, sustainable path. After a wild few years, we’re now seeing confidence without complacency, growth without irrational exuberance. It’s a market where honesty and clarity pay off – exactly the environment where Sarah Kaye & Co.’s ethos of radical honesty and diligent advocacy thrives.

We’ll continue to monitor the data and tell it like it is. For now, the truth is that Northern Beaches real estate remains a solid long-term bet, and the remainder of 2025 is poised to build gently on the gains we’ve witnessed so far. Prices aren’t running away, but they are rising, and that reflects the enduring appeal of this extraordinary part of Sydney. Here’s to a strong finish to 2025, with 2–4% growth that’s grounded in reality – and as always, we’ll be here to guide you through every step with transparency and expertise.