The New Face of Retirement: From Downsizing to ‘Rightsizing’

A profound demographic and economic shift is reshaping Australia’s prestige property markets, with Sydney’s Northern Beaches emerging as a key epicentre. This transformation is driven by the Baby Boomer generation (born 1946-1964), a cohort wielding unprecedented financial power and redefining the concept of retirement living. The traditional narrative of “downsizing”—a move to a smaller, more modest home—is being replaced by “rightsizing,” an aspirational, wealth-driven pivot to high-end, low-maintenance properties that prioritize lifestyle upgrades over simple space reduction. This report analyzes the mechanics of this trend, its specific manifestation in the Northern Beaches luxury apartment market, and its far-reaching implications for developers, buyers, and the future character of the region’s most desirable suburbs.

The Boomer Balance Sheet: A Generation of Unprecedented Wealth

The market-shaping capacity of the Baby Boomer generation is fundamentally enabled by its immense financial dominance. This cohort represents just 21% of the Australian population but controls nearly half of the nation’s private wealth. They are, by a significant margin, the wealthiest generation of retirees in the country’s history, possessing an average household net worth of $1.6 million—a figure 60% higher than the national average—and a cumulative national wealth approaching $4 trillion.

A critical component of this wealth is tied up in the family home, often owned for decades in blue-chip suburbs. As this generation enters retirement, the sale of these high-value assets unlocks substantial capital. This process creates a formidable buyer pool that is highly capitalized, often cash-ready, and significantly less sensitive to the interest rate fluctuations and mortgage constraints that govern other market segments. This financial firepower allows them to compete fiercely for desirable properties, paying a premium to secure a home that meets their specific and exacting criteria.

The Motivation Matrix: Beyond the Empty Nest

The decision to move is no longer a passive reaction to an empty nest but a proactive and strategic choice for a new phase of life. The motivations are multifaceted and reflect a fundamental shift in retirement aspirations.

A primary driver is the desire for proximity to family, fuelling what can be termed the “grandparent economy.” A growing number of retirees are rejecting traditional sea or tree changes, instead choosing to relocate closer to their adult children and grandchildren to play a more active role in their lives. Data from major developers like Mirvac underscores this trend, revealing that downsizers have grown from just 5% of their NSW apartment buyers in 2020 to nearly 40% in 2025.

A second core motivation is the liberation from the burdens of property maintenance. A key “push factor” is the desire to escape the physical and financial upkeep associated with large, older family homes. The ideal property is one that offers a “lock-up-and-leave” lifestyle, facilitating travel, hobbies, and other pursuits without the worry of garden and home maintenance. This move is also framed as a distinct lifestyle upgrade. This cohort is not seeking a downgrade in quality; rather, they are pursuing properties that represent an improvement in their living standards. For many, this is their first experience living in a brand-new home, complete with modern kitchens, luxurious bathrooms, and contemporary design—a stark contrast to the older homes where they raised their families.

Finally, these buyers are planning for the long term, with a focus on “aging in place.” This translates into a strong preference for single-level layouts, lift access from secure parking, and architectural features that can be adapted for future mobility needs, ensuring they can remain in their new homes for decades to come.

Redefining “Downsizing”: The Rise of the ‘Aspirational Rightsizer’

Given these motivations, the term “downsizing” has become a misnomer. The market demand is not for smaller properties, but for large, often three-bedroom, luxury apartments that offer house-like proportions and amenity without the associated maintenance. This movement is more accurately described as “rightsizing”—a deliberate calibration of one’s home to match current lifestyle priorities, where quality, convenience, and experiences are valued more highly than sheer land size. The objective is not merely to reduce square meterage but to gain more time, comfort, and freedom to enjoy a vibrant and active retirement. This shift in consumer psychology from a passive retreat to an active redeployment of capital for a fulfilling “third act” is the central force reshaping the top end of the apartment market.

The Non-Negotiables: A Rightsizer’s Wishlist

The aspirational rightsizer is a discerning buyer with a clear and specific vision for their next home. This has created a well-defined set of property attributes that are in high demand, leading to significant price distortions and the emergence of a distinct, high-performing sub-market for larger luxury apartments.

Analysis of new developments and buyer preferences reveals a consistent checklist of essential features:

- Space and Layout: A minimum of three bedrooms is frequently a non-negotiable requirement. This provides flexibility for a guest room, space for visiting grandchildren, a home office, or a dedicated hobby room. The internal layout must feature open-plan living, generous entertaining areas, and a seamless flow between indoor and outdoor spaces like large balconies or private courtyards.

- Quality and Luxury: A high level of finish is expected as standard. This includes premium European appliances (such as Miele), stone benchtops, integrated gas fireplaces, fully ducted air conditioning, and luxury appointments like heated bathroom floors.

- Accessibility and Convenience: Single-level living is paramount, supported by direct lift access from secure basement parking to the residence. Modern conveniences that cater to a sophisticated buyer, such as number plate recognition for garage entry and provisions for electric vehicle (EV) charging, are increasingly common.

- Location: Proximity to established and familiar “village” centres is a critical driver. Rightsizers want to remain within their communities, close to cafes, boutique shops, medical facilities, and public transport options that they have relied on for years.

The Three-Bedroom Phenomenon: A Market Divided

The intense demand for these specific features has cleaved the apartment market in two, creating a “two-speed” environment. While the broader Sydney unit market has experienced periods of flat or even negative growth, large, luxury apartments in desirable suburbs have defied this trend, recording “considerable growth”. This divergence is driven almost entirely by the rightsizer cohort, who have created a micro-boom at the top end of the unit market, particularly for three-bedroom configurations.

The financial premium for this third bedroom is stark. On the Northern Beaches, the median price difference between a two-bedroom and a three-bedroom unit is approximately $770,000—one of the most significant price gaps for an additional bedroom in all of Sydney. This figure is a powerful quantitative indicator of the intense and concentrated demand for the space and flexibility that rightsizers require.

Data Deep Dive: Quantifying the Premium in Manly

The suburb of Manly provides a compelling case study of this market bifurcation. A granular analysis of recent sales data reveals a dramatic and opposing performance between two- and three-bedroom apartments, confirming that they are effectively operating in separate markets driven by different demographic forces.

As of September 2025, three-bedroom units in Manly commanded a median price of $3,250,000 and had experienced robust annual price growth of 6.4%. In stark contrast, two-bedroom units in the same suburb had a median price of $1,780,000 and had seen their value decline by 2.2% over the same period.

|

Property Type |

Median Sale Price |

Annual Price Growth (YoY) |

|

2-Bedroom Unit |

$1,780,000 |

-2.2% |

|

3-Bedroom Unit |

$3,250,000 |

+6.4% |

|

Data for Manly, NSW, for the 12 months to September 2025. |

|

|

This data offers irrefutable evidence that the rightsizer demographic is not just influencing the market but creating a distinct, high-performing asset class insulated from the broader trends affecting smaller, investor-grade apartments. The performance gap creates a significant barrier for other buyer types, such as young families looking to upsize from a two-bedroom to a three-bedroom apartment. They face the dual challenge of their existing asset potentially stagnating in value while the property they aspire to purchase is rapidly appreciating, widening the affordability gap and further entrenching the market power of their cash-rich rightsizer competitors.

The Northern Beaches Magnet: A Perfect Storm of Lifestyle and Location

The concentration of the rightsizing trend on the Northern Beaches is no coincidence. The region offers a unique and powerful combination of lifestyle attributes, community connection, and practical amenities that aligns perfectly with the aspirations of the modern, affluent retiree.

At its core, the Northern Beaches’ appeal lies in its unique proposition: a relaxed, resort-like atmosphere within commuting distance of a global city. This “best of both worlds” scenario, which drove a surge in demand during the post-COVID era, is particularly attractive to those transitioning out of the full-time workforce. The lifestyle is intrinsically linked to the outdoors, with easy access to iconic beaches, waterways for boating and kayaking, coastal walks, and golf courses. This environment naturally promotes an active and healthy lifestyle, which is a key priority for retirees seeking to maximize their wellbeing. The region offers a slower, more deliberate pace of life, providing a welcome escape from the “rat race” without sacrificing sophisticated amenities.

Village Life and Community Connection

Beyond the natural landscape, the appeal is deeply rooted in the vibrant village hubs that characterize suburbs like Manly, Avalon, and Mona Vale. These centres offer a rich tapestry of boutique shops, local cafes, and high-quality restaurants, fostering a strong sense of community. This is a crucial factor for rightsizers, many of whom are long-term residents deeply embedded in their local area. The ability to move into a luxury apartment just a short stroll from their familiar social networks, friends, and local amenities is a powerful incentive, combating the potential for social isolation that can be a concern in retirement.

Infrastructure and Amenity

The Northern Beaches is not a remote “sea change” destination; it is a well-serviced and practical place to live. The presence of major infrastructure, most notably the Northern Beaches Hospital, provides a critical anchor for the region and offers peace of mind for an aging demographic that prioritizes access to high-quality healthcare. This is complemented by reliable transport links, including the iconic Manly ferry, and a sophisticated retail and dining scene that meets the expectations of a discerning and affluent population. This combination of aspirational lifestyle and practical infrastructure makes the Northern Beaches a complete and compelling proposition. Developers and agents in the region are effectively monetizing “wellbeing,” selling not just a property but access to a curated ecosystem that promotes health, community, and relaxation—a package for which affluent rightsizers are willing to pay a significant premium.

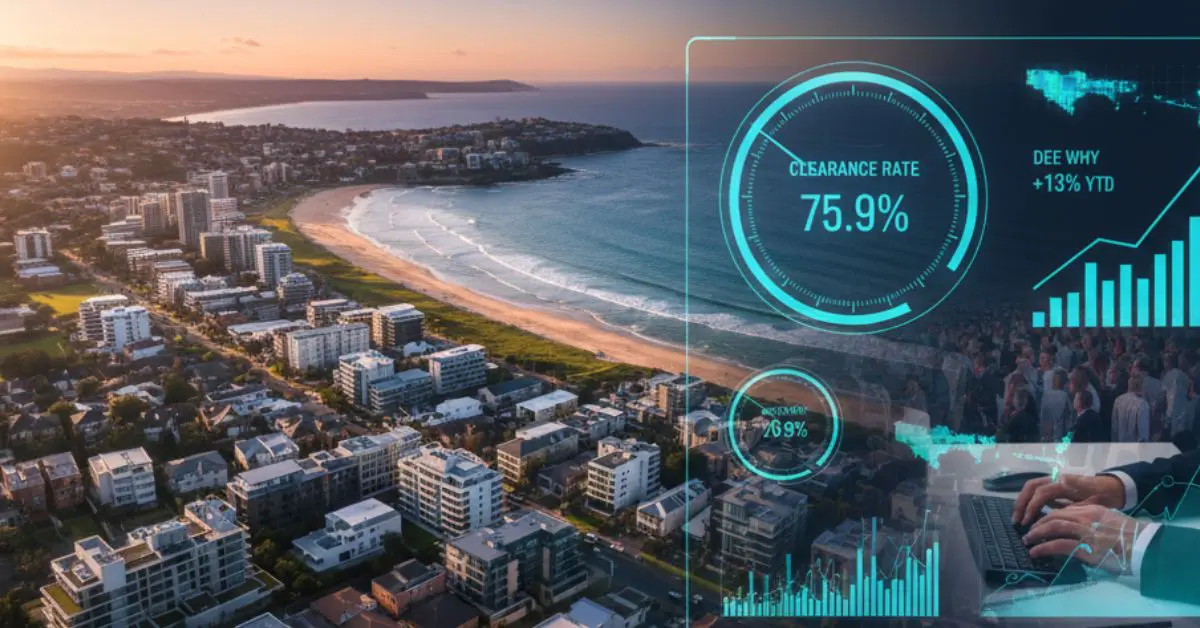

Hotspot Analysis: A Suburb-by-Suburb Deep Dive

The rightsizing phenomenon is not uniform across the peninsula; it manifests in different ways depending on the suburb’s character, existing housing stock, and development pipeline. A granular analysis of key hotspots reveals both the consolidation of demand in established prestige markets and the emergence of new epicentres where supply is actively being shaped to meet this demand.

Manly: The Established Prestige Hub

Manly serves as the quintessential example of the bifurcated apartment market. Its vibrant cosmopolitan atmosphere, direct ferry access to the CBD, and world-famous beach make it a perennial top-tier destination for affluent buyers. As detailed previously, the market here is sharply divided. The intense competition among rightsizers for the limited supply of large, premium apartments has driven 6.4% annual growth for three-bedroom units, while the more abundant two-bedroom stock has seen values fall by 2.2%. This demonstrates how tightly held and sought-after the rightsizer-appropriate properties are, creating a market largely insulated from broader trends.

Palm Beach & Whale Beach: The Bastions of Scarcity

At the northern tip of the peninsula, Palm Beach and Whale Beach represent the ultra-luxury end of the market. These suburbs are defined by their exclusivity, natural beauty, and, critically, an extreme scarcity of land and property. With median house prices exceeding $5 million, these are enclaves for the very wealthy. The supply of apartments or low-maintenance luxury homes is exceptionally limited. Consequently, when such a property does become available, it is met with fierce competition from rightsizers seeking a prestigious and secluded coastal retreat, often driving prices to record levels.

The New Epicentres: Mona Vale, Collaroy, and Avalon

While Manly and Palm Beach are defined by demand overwhelming existing supply, a different story is unfolding in the mid-peninsula suburbs. Here, the development industry is actively responding with a wave of new boutique projects explicitly designed for and marketed to the rightsizer demographic.

- Case Study: ‘Bayside’ Mona Vale: This development is a textbook example of a product tailored to the rightsizer wishlist. A boutique collection of just 12 oversized three-bedroom residences, its marketing highlights single-level living, lift access, high-end Miele appliances, a flexible third bedroom that can function as a media room, and proximity to Mona Vale village. Its near sell-out status, with marketing proclaiming “ONLY ONE REMAINS,” confirms the viability of this targeted approach.

- Case Study: ‘Ohana’ Collaroy: This project elevates the offering to absolute beachfront, targeting the upper echelon of the rightsizer market. Designed by the acclaimed architectural firm PopovBass, it focuses on delivering uncompromising ocean vistas, expansive interiors, and a seamless “lock-up-and-leave” lifestyle for those seeking the ultimate coastal address.

- Case Study: ‘Norfolk Residences’ Avalon: Another boutique collection of 10 apartments and townhomes, this project is explicitly marketed as being “created specifically with the needs of downsizers in mind”. The marketing strategy cleverly leverages the scarcity of such developments in North Avalon’s low-density residential zoning, creating a sense of urgency and positioning the properties as a rare and valuable long-term asset.

The proven success of these hyper-targeted developments provides a profitable blueprint for the industry. This will inevitably incentivize other developers to acquire sites in these suburbs to replicate the model, leading to an influx of high-end projects and affluent residents that will accelerate the premiumization and gentrification of these mid-peninsula villages.

The Supply-Side Response: Developers Pivot to the Grandparent Economy

The intense and sustained demand from rightsizers has triggered a strategic realignment within the property development industry. Recognizing a lucrative and underserved market segment, developers are pivoting away from their historical focus on investors and first-home buyers to cater directly to the needs of the affluent “grandparent economy.”

The Historical Supply Crunch

Historically, developers in suburban Australia have concentrated on building one- and two-bedroom apartments. This product was aimed primarily at the investor market, due to lower price points and higher rental yields, or at first-home buyers. This focus has resulted in a structural undersupply of the large, high-specification, house-sized apartments that rightsizers are now demanding. This mismatch between historical supply and current demand is a key factor fuelling the intense price competition and rapid value appreciation for the limited number of suitable properties available on the market.

A Strategic Pivot to Premium Owner-Occupiers

Astute developers have identified this market gap and are actively reorienting their strategies. Major national players like Mirvac and Lendlease have publicly noted the strength of the downsizer market and are pivoting projects to target this demographic. On the Northern Beaches, this trend is even more pronounced. Specialist project marketing firms now explicitly state their mission is to deliver high-end luxury apartments and townhomes to those looking to “right size” their lives, positioning themselves as the leading providers for this specific market segment. This pivot is a direct and rational response to clear market signals; developers understand that the Boomer cohort has the capital and is willing to purchase premium properties, often off-the-plan, provided the product meets their exacting standards for quality, space, and location.

The Role of Planning Reform

This supply-side response is being facilitated and accelerated by government policy. Recent planning changes, such as the NSW Low and Mid-Rise Housing Policy, are acting as a powerful catalyst. These reforms are designed to encourage greater housing density around established town centres and transport hubs. This is critically important for enabling the rightsizing trend, as it unlocks land for the development of high-quality apartments and townhouses in the very locations where older homeowners want to live. By creating a pathway for the construction of suitable alternatives, these policies help overcome one of the biggest historical roadblocks to downsizing: the lack of desirable places to move to within one’s own community.

This dynamic creates a powerful feedback loop. As new, suitable rightsizer stock is built, it encourages more older residents to sell their large family homes. This increases the supply of traditional housing for the next generation of families. However, the multi-million-dollar sales of these homes inject even more liquid capital back into the hands of the rightsizers, further fuelling competition for the limited number of new luxury apartments being delivered. This ensures that demand for premium rightsizer stock will remain robust and prices are likely to continue their upward trajectory.

Market Forecast and Strategic Implications

The convergence of demographic destiny, unprecedented wealth, and lifestyle aspiration has created a powerful and enduring market force. The rightsizer-driven boom in the Northern Beaches luxury apartment sector is not a fleeting trend but a structural shift with long-term consequences for all market participants.

The Longevity of the Silver Tsunami

This is a generational trend with a long runway. The Baby Boomer cohort currently ranges in age from the late 50s to the mid-70s, meaning there is a sustained pipeline of potential rightsizers who will be making housing decisions over the next decade and beyond. Australia’s population of residents aged over 65 is at its demographic peak and will continue to grow due to increasing longevity. This ensures a deep and consistent demand base for properties that cater to their needs for many years to come.

Ripple Effects: Opportunities and Challenges

The dominance of the rightsizer cohort creates a series of ripple effects across the market, presenting both opportunities and challenges for other stakeholders.

- For Younger Families: The primary challenge is being priced out of the larger apartment market. The immense buying power of cash-rich rightsizers makes it exceedingly difficult for younger, mortgage-dependent families to compete for three-bedroom apartments, impeding their ability to upsize within their desired communities.

- For Existing Owners: Individuals who already own three-bedroom apartments in prime Northern Beaches locations are holding a highly desirable and appreciating asset class. They are in an advantageous position to capitalize on this concentrated demand should they choose to sell.

- For Investors: While rental yields on these premium properties are modest (e.g., approximately 2.6% for a three-bedroom unit in Manly), the potential for significant capital growth is the main attraction. A secondary opportunity may lie in acquiring older, unrenovated family homes from rightsizers, which can be redeveloped or refurbished to meet the needs of the next generation of buyers.

Strategic Conclusion: Marketing to the New 60

The fundamental takeaway for agents, developers, and market observers is that “60 is the new 30” in the prestige property market. This demographic should not be viewed as passively exiting the market, but as an active, aspirational, and financially formidable consumer group that is actively reshaping it. They are not simply buying a smaller home; they are investing in a bigger life. Consequently, marketing and development strategies must pivot to focus on lifestyle, quality, convenience, and the promise of a vibrant and fulfilling next chapter. Success in this new market paradigm will belong to those who understand that they are selling access to a desirable future, not just bricks and mortar.