The Northern Beaches in Focus: A Tale of Two Markets (Q4 2025 & 2026 Outlook)

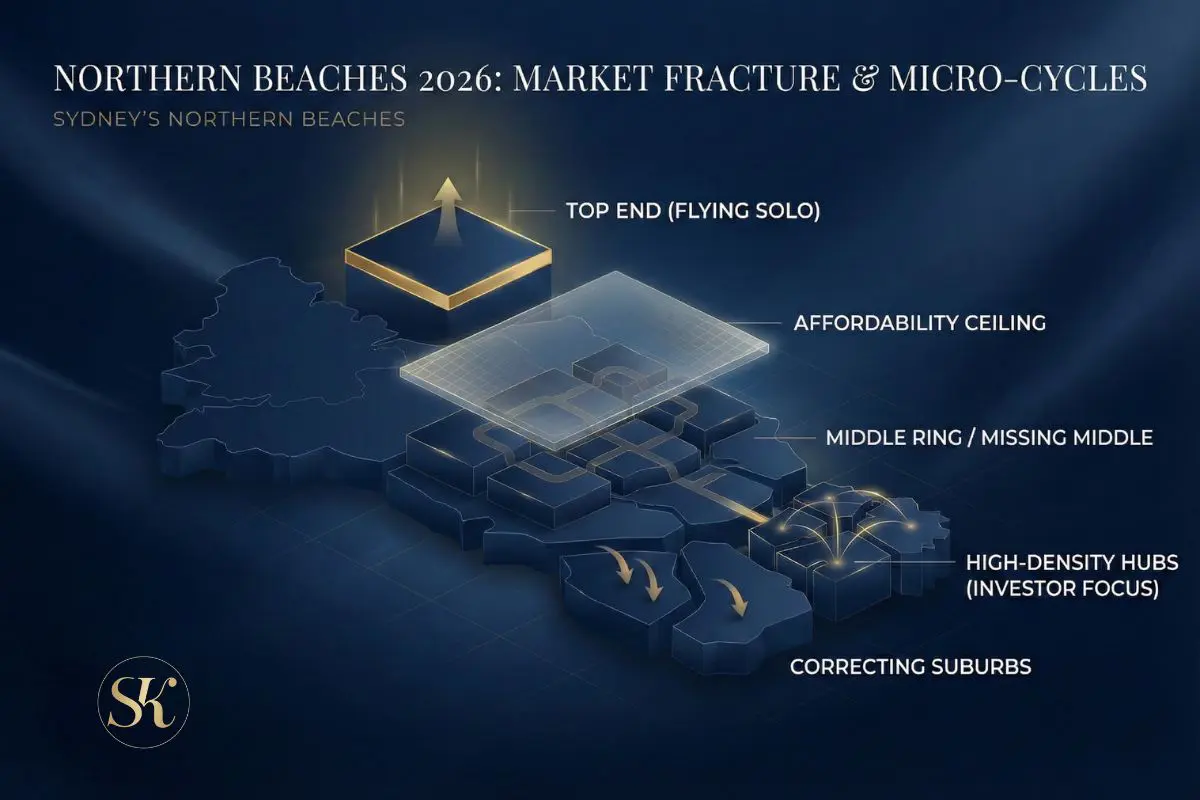

As we close the book on 2025, the Northern Beaches property market has emerged as one of the most fascinating—and fragmented—regions in Sydney. The data for the fourth quarter of 2025 reveals a market that is no longer moving in unison. Instead, we are witnessing a sharp divergence: a “super-prime” sector that is surging ahead, decoupled from economic gravity, and a “family mortgage belt” that is tapping the brakes as borrowing capacity hits its ceiling.

For buyers, sellers, and investors, the headline figures of Sydney’s 8.6% annual growth hide the real story. On the Beaches, hyper-local dynamics are dictating value. This report breaks down the specific performance of houses and units across the peninsula in Q4 2025 and offers a high-level forecast for what 2026 holds.

The House Market: Trophy Hunters vs. Borrowing Realities

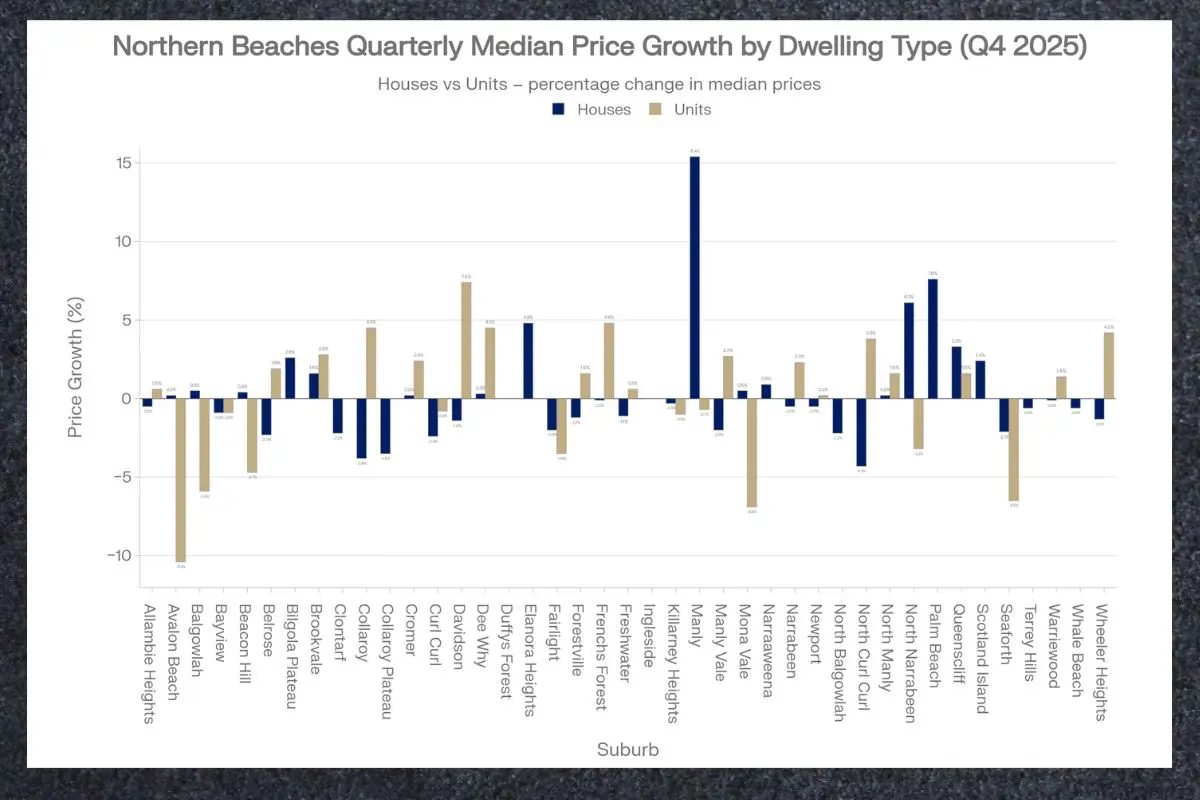

The narrative for detached houses in Q4 2025 was defined by the split between cash-heavy luxury buyers and finance-dependent families. While the broader Sydney market hit a “speed bump” in late 2025, specific Northern Beaches enclaves recorded some of the highest growth rates in the country.

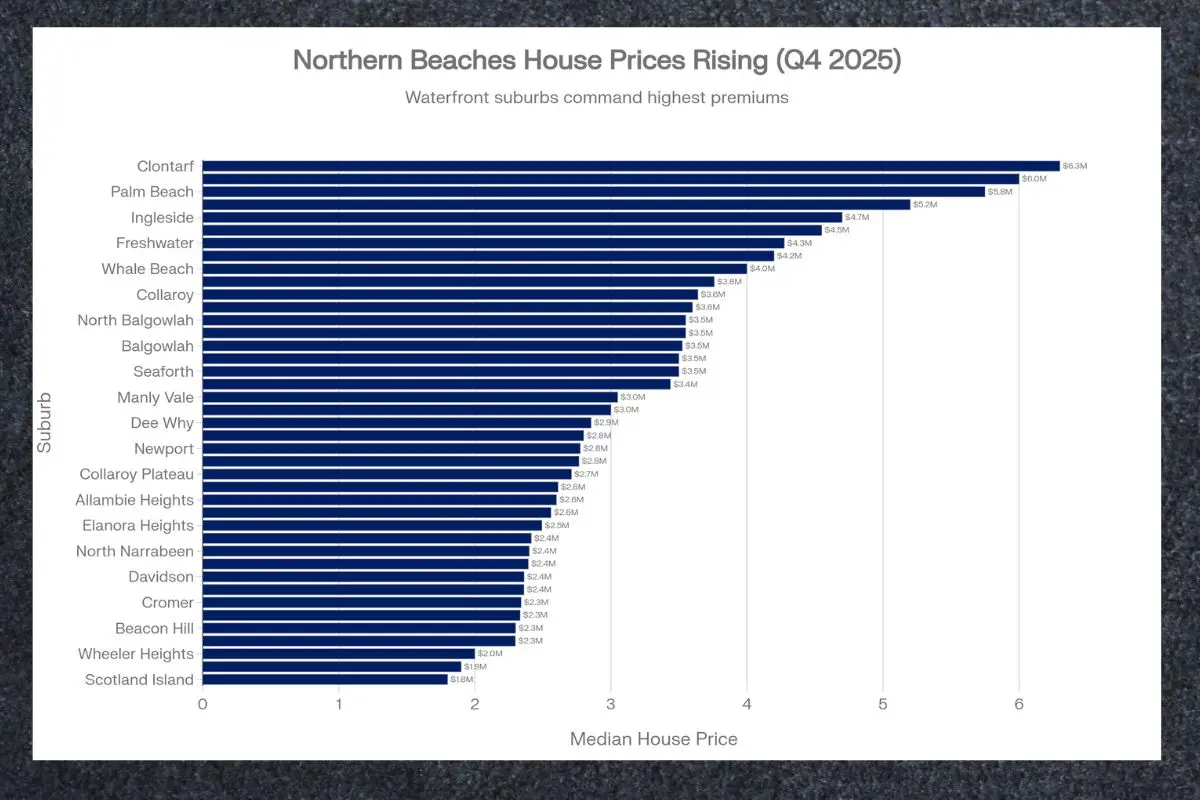

The Winners: The “Trophy” Shield

The standout performer of Q4 was undoubtedly Manly. While other premium markets softened, Manly house prices surged by a staggering 15.40% in a single quarter, pushing the median price to $5.2 million. This growth is not driven by standard market fundamentals such as interest rates; rather, it is fuelled by scarcity and “trophy” appeal. High-net-worth individuals, unencumbered by mortgage stress, are competing for limited stock in what is arguably Sydney’s most famous lifestyle hub.

Similarly, Palm Beach defied the broader slowdown, recording 7.60% quarterly growth to reach a median of $5.75 million. With a median resident age of 60+, this market operates as a “luxury tip,” insulated from cost-of-living pressures by accumulated wealth.

Interestingly, we also saw a surge in North Narrabeen, where prices rose by 6.10%. This likely represents a “flight to value.” With a median price of $2.4 million, North Narrabeen offers the quintessential “lagoon meets ocean” lifestyle at a significant discount compared to its southern neighbours like Collaroy ($3.64m) or Long Reef. Families priced out of the lower beaches are moving north, driving up competition in these middle-market suburbs.

The Correction: The Mortgage Ceiling

Conversely, the “prestige family” suburbs—those traditionally reliant on high-income professionals taking out large mortgages—are seeing a correction.

North Curl Curl experienced a sharp quarterly decline of -4.30%, bringing its median to $3.6 million. Collaroy followed suit with a -3.80% drop. These suburbs sit in a difficult price bracket ($3.5m–$4m) where buyers are heavily impacted by APRA’s tightening of lending standards. With borrowing capacity capped at six times income, many professional families simply cannot service the debt required to enter these markets, forcing vendors to adjust expectations downward.

Clontarf (-2.20%) and Seaforth (-2.10%) also saw mild corrections. These gateway suburbs often serve as the first port of call for buyers moving from the Lower North Shore, suggesting that the weakness in the broader Mosman market (-8.6%) is bleeding across the Spit Bridge.

The Unit Market: Volatility and the “Missing Middle”

The unit market on the Northern Beaches is telling a story of extreme volatility, particularly in lifestyle-focused suburbs, while high-density utility hubs remain robust.

The “Crash” in Holiday Hubs

The most shocking data from Q4 came from Avalon Beach, where unit prices plummeted by -10.40%. This double-digit drop in a single quarter suggests a retreat of discretionary capital. Avalon units often serve as holiday homes or secondary investments; as land tax and holding costs rise, investors appear to be offloading these non-essential assets. Mona Vale units also struggled, dropping -6.90%, despite the suburb acting as a key service hub.

The Strength in Utility

In contrast, suburbs that offer connectivity and genuine residential utility performed well. Collaroy units jumped 4.50%, likely driven by young professionals priced out of Manly but wanting the beachside lifestyle along the B-Line.

Dee Why, the high-density engine room of the Beaches, proved its resilience. It recorded 4.50% growth and a solid rental yield of 3.90%. With high liquidity (565 sales in 12 months) and a median price of $892k, Dee Why remains the default choice for first-home buyers and investors seeking safety in numbers.

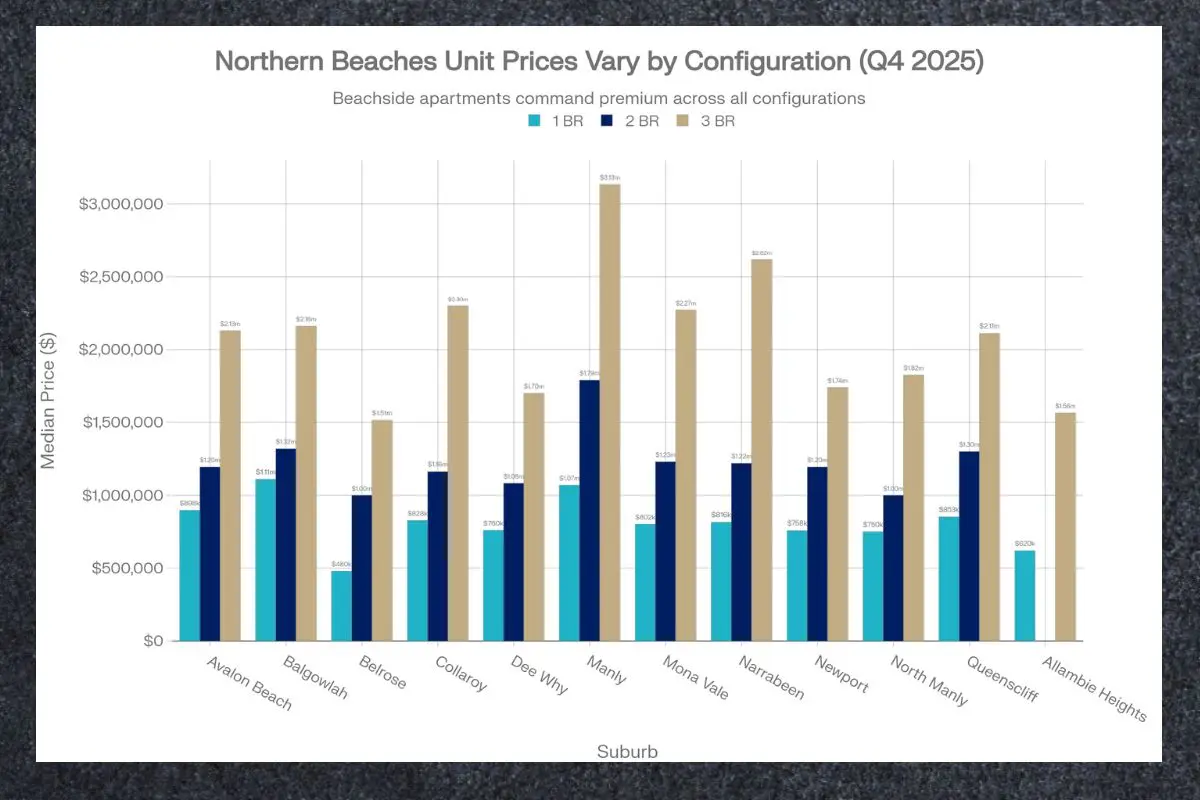

Detailed Bedroom Analysis: The Cost of an Extra Room

Where data allow, we can see significant price premiums for extra space, highlighting the desperate shortage of family-sized apartments (the “missing middle”).

Manly (The Premium Hub):

- 1-Bed Median: $1.07m

- 2-Bed Median: $1.79m

- 3-Bed Median: $3.133m

- Insight: The jump from a 2-bed to a 3-bed apartment in Manly is over $1.3 million. This massive premium reflects the scarcity of downsizer-friendly stock. Buyers are paying house prices for 3-bedroom apartments to secure the lifestyle without the maintenance.

Dee Why (The Value Hub):

- 1-Bed Median: $760k

- 2-Bed Median: $1.083m

- 3-Bed Median: $1.70m

- Insight: Dee Why offers a much more linear price progression. A 3-bedroom unit here costs less than a 2-bedroom unit in Manly, making it a key target for upsizing families who can’t afford a house.

Mona Vale (The Upper Beaches Hub):

- 1-Bed Median: $802k

- 2-Bed Median: $1.23m

- 3-Bed Median: $2.272m

- Insight: Similar to Manly, the premium for a 3-bedroom unit is steep (over $1m jump from a 2-bed). This indicates strong demand from local downsizers who want to stay in the upper beaches but are competing for very limited stock.

Freshwater (The Village Alternative):

- 1-Bed Median: $785k

- 2-Bed Median: $1.268m

- Insight: Freshwater offers 1-bed units at a comparable price to Dee Why, but the 2-bed stock commands a premium, reflecting the suburb’s village appeal and tight supply.

Outlook for 2026: The “Speed Bump” and The Recovery

Looking ahead to the remainder of 2026, the Northern Beaches market will likely navigate a “multi-speed” recovery. The forecast is for moderate growth, tempered by affordability constraints but supported by chronic undersupply.

1. Price Forecasts: Moderate Gains

While 2025 saw rapid acceleration, 2026 is predicted to be a year of consolidation. KPMG forecasts Sydney prices to rise by 5.8%, while Domain is more bullish, predicting up to 10% growth for the financial year. For the Northern Beaches, this likely means the “trophy” markets (Manly, Palm Beach) will continue to outperform, while the middle markets (Dee Why, Narraweena) will track the broader 5-6% average.

2. The Interest Rate “Wild Card”

The trajectory of 2026 hinges on the RBA. Recent inflation data has renewed fears of a rate hike or a “higher for longer” strategy. If rates rise, borrowing capacity will shrink further.

- Risk: Suburbs currently correcting (North Curl Curl, Collaroy) could see further softness as the pool of buyers capable of borrowing $3m+ shrinks.

- Opportunity: This will push demand down the price ladder. Expect continued strength in “affordable” house markets like North Narrabeen and Elanora Heights, and high-utility unit markets like Brookvale and Dee Why.

3. The “Missing Middle” Crisis

The data highlights a critical gap in the market: 3-bedroom units. With the median house price in Sydney nearing $2 million and premium Beaches suburbs well above $3m, families are being priced out of detached homes.

- Trend: We expect fierce competition for townhouses and 3-bedroom apartments in 2026. Suburbs that offer this stock (like Warriewood and Dee Why) will likely see these specific asset types outperform the broader unit market.

4. Investor Strategy: Yield vs. Growth

For investors, the days of easy capital gains across the board are paused.

- Yield Play: Brookvale (4.0% yield) and Dee Why (3.9% yield) offer the best cash flow on the beaches, supported by low vacancy rates and high tenant demand from the B-Line.

- Growth Play: Manly remains the blue-chip growth engine, but the entry price is prohibitive for most. A smarter play might be North Narrabeen or Warriewood, capitalising on the “ripple effect” as buyers are pushed north.

Conclusion

The Northern Beaches market in 2026 is no longer a single entity. It is a series of micro-markets that behave differently based on price point and buyer demographics.

- Sellers in the $3m–$5m range need to be realistic about borrowing constraints.

- Buyers should look for value in the “correcting” suburbs or target the “missing middle” 3-bedroom units before the gap widens further.

- Investors should focus on connectivity and yield in high-density hubs rather than speculating on volatile holiday rentals in the far north.

As the year progresses, watch for the “affordability ceiling” to become the defining feature of the market, capping growth in the middle ring while the top end continues to fly solo.