Overview

Northern Beaches Property Market Spring 2025.

Let’s get real. As leading Buyers Agents, we know firsthand that the Sydney Northern Beaches property market isn’t governed by sentiment; it’s driven by severe scarcity and sustained demand from a highly affluent, lifestyle-driven buyer pool. Forget the media noise about rates and affordability; the reality on the ground now is a fiercely competitive, highly nuanced seller’s market.

This is a tactical breakdown of exactly what’s happening—the metrics, the micro-markets, and the immediate implications for both buyers and vendors. If you’re transacting right now, this is your unfiltered guide to market velocity, vendor behaviour, and the subtle differences that determine success.

The Hard Numbers – Inventory, Velocity, and Demand Heat

The Northern Beaches market has transitioned from post-correction volatility into a phase of measured, resilient growth in 2025. The underlying dynamic, however, remains brutally simple: too many buyers, not enough homes. The supply crisis is structural, amplified by geography and restrictive planning controls.

The Spring Supply Pulse vs. Chronic Scarcity

Yes, we saw a “spring supply pulse”. New listings lifted through late August and September as vendors aimed for a pre-Christmas settlement. But this did not translate into a flood of choice.

Across Sydney, total inventory levels remain chronically constrained, running 13.3 per cent below the previous five-year average. On the Beaches, this deficit is even more acute. Any increase in new listings is immediately absorbed by a determined buyer pool. This constant absorption prevents meaningful accumulation of stock, sustaining upward price pressure.

Tactical Takeaway for Buyers: You cannot afford to wait for stock levels to materially improve. The brief lift in listings in spring is the peak of your choice window; listings will tighten again through late Q4. You must act decisively when quality stock hits the market.

Velocity: Days on Market (DOM)

Sales velocity is the cleanest measure of buyer urgency and price acceptance. The data confirms an intensely competitive environment for A-grade stock:

- Market Average DOM: The regional average Days on Market across the Beaches sat at approximately 25 days in August.

- A-Grade Stock Velocity: Properties handled by high-performing local agencies recorded an average DOM of just 12 days.

The Blunt Truth: If a property is well-presented, correctly priced, and highly sought-after, it often sells in less than three weeks. If a comparable property has been on the market for 30+ days, it signals vendor overpricing or a fundamental flaw in the presentation or marketing. Buyers can tactically use extended DOM to identify truly motivated sellers, but they should not expect to negotiate significant price reductions on fresh, premium stock.

Quantifying Buyer Demand

The level of buyer activity in August and September was exceptionally high. Digital engagement metrics from local agents confirmed massive interest, with one agency reporting 121,900 total views and 76,800 engagements across their listings in August alone. Crucially, there were 5,000 saves and shares reported, underscoring strong buyer intent and commitment to action.

Key Buyer Source: Enquiry levels are not solely local. Significant interest remains consistent from house hunters migrating from other premium Sydney markets, including the North Shore, Eastern Suburbs, and Inner West. This concentration of external wealth underpins the sustained price resilience of the Beaches, validating it as a top-tier lifestyle destination.

The Auction Arena and Vendor Strategy

The state of the auction market provides the clearest insight into vendor confidence and buyer aggression.

Clearance Rates: A Seller’s Domain

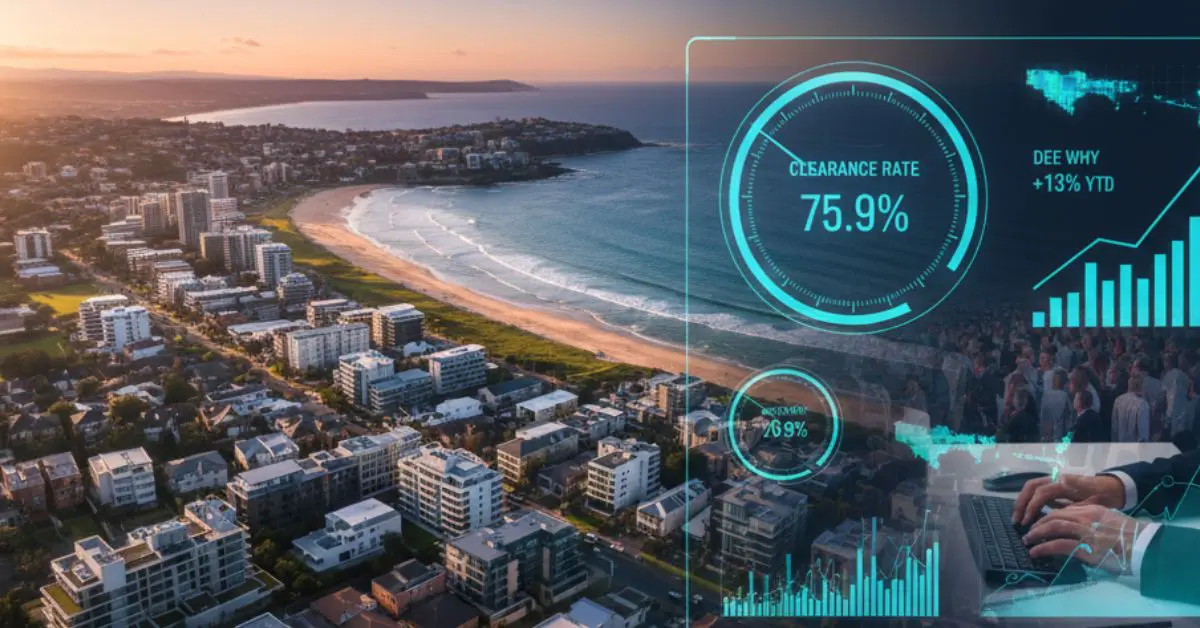

Sydney’s aggregate auction clearance rates in September stabilised robustly between 72 percent and 74 percent. The Northern Beaches consistently outperformed this benchmark, recording a clearance rate of approximately 75.9 percent in early September.

A clearance rate consistently above 70 percent is the definitive sign of a seller’s market. This high success rate confirms two things:

- Vendor Pricing Confidence: Sellers are setting reserves that are being consistently met or exceeded by competitive bidding.

- Buyer Competition: Competition is fierce enough to push the majority of properties across the line, validating vendor expectations.

The “Sold Prior” Premium: Tactical Vendor Leverage

A key strategic move that’s defining the market activity is the high rate of properties being sold prior to auction. Across Sydney, up to 40 per cent of successful auction campaigns are actually secured before the scheduled date.

Tactical Implication: Buyers are making aggressive, unconditional pre-auction offers to eliminate competition and guarantee a purchase in a low-stock environment. For the vendor, accepting an unconditional offer prior is a low-risk, high-certainty strategy. For the buyer, this tactic carries a financial cost—you are almost always paying a premium to guarantee the deal and avoid the uncertainty of auction day. In this tight market, accepting that premium is often a necessary evil to secure a quality home.

Vendor Readiness: The Turnkey Premium

Buyers right now are discerning. They are factoring high building costs and builder scarcity into their purchasing decisions. This translates to a massive, quantifiable premium for turnkey properties.

The Truth for Vendors: Overpriced or poorly presented homes, particularly units, can still stall and may be subject to longer DOM. Conversely, impeccably renovated, ready-to-move-in homes command a substantial premium and often achieve a rapid 10-15 day DOM. If you are selling, presentation and pre-market repairs are non-negotiable—they directly determine your price and velocity.

Suburb Segmentation – Not One Market, but Many

The Northern Beaches is not a monolithic entity. There are sharp differences in growth trajectory, velocity, and core drivers between micro-markets.

The High-Growth, High-Velocity Hubs (Dee Why & Avalon)

These suburbs are being fuelled by a mix of affordability (relative to the Lower Beaches) and structural demand.

- Dee Why: The undisputed growth leader. Dee Why house prices saw approx. +13 percent YTD growth, with units achieving +9 percent YTD growth. Its appeal is tactical: superior centrality, relative affordability, and investor appeal, with strong unit yields often reaching 3–4 percent. Sales velocity here is rapid.

- Avalon: A strong performer in the unit segment, recording +4.5 percent YTD growth for units. This confirms Avalon’s ongoing desirability as a lifestyle precinct for downsizers and young professionals, with strong rental market confidence.

The Infrastructure-Driven Upgrader Markets (Frenchs Forest & Balgowlah)

These areas are being driven by future amenity and state planning policy.

- Frenchs Forest: Forecast for above-average growth over the next 18 months. Why? Buyers are “buying the story” of future amenity: the new Northern Beaches Hospital is open, and a new town centre with thousands of homes is planned. This attracts young families seeking larger blocks and anticipating future lifestyle benefits. Auction clearance rates have been notably strong here recently.

- Balgowlah: Along with Dee Why, this suburb is identified as a key centre for the immediate impact of the NSW Low & Mid-Rise Housing (LMRH) reforms. This policy change is creating immediate developer interest, as certain compliant R2 and R3 zoned sites within 800 metres of the town centre are now eligible for increased density. This reform is reshaping land value instantly in these specific corridors.

The Ultra-Prestige, Low-Liquidity Markets (Palm Beach & Manly)

These segments operate independently of volume and affordability concerns.

- Palm Beach: Highly desirable but extremely low-liquidity. Houses here recorded an average DOM of 140 days. This extended velocity reflects a bespoke, ultra-prestige market where sales are infrequent and driven by the unique demands of ultra-high-net-worth individuals, not volume demand. However, it recorded a +37 percent rebound from its 2024 trough, demonstrating the power of its inherent value.

- Manly: Remains the premium benchmark, holding steady at the absolute top end.

|

Suburb/Segment |

Key Statistic (Aug-Sep 2025) |

Tactical Implication |

|

Growth/Affordability Hub |

Dee Why (Houses) |

+13% YTD Growth, Rapid Sales Velocity |

|

Growth/Affordability Hub |

Dee Why (Units) |

+9% YTD Growth, 3–4% Rental Yield |

|

Emerging Upgrader Market |

Frenchs Forest (Houses) |

Notably Strong Auction Clearance Rates |

|

Ultra-Prestige Lifestyle |

Palm Beach (Houses) |

140 Days on Market (Avg) |

The Future is Now—NSW Low & Mid-Rise Housing (LMRH)

The most immediate, ground-level change impacting land value is the implementation of the NSW LMRH reforms. The new rules are in effect now and apply within 800 metres of nine nominated centres on the Beaches, including Dee Why and Balgowlah.

What it means: These policies override Council’s existing standards, permitting greater density (terraces, townhouses, and mid-rise apartments). For compliant sites (especially R2 and R3 zoned blocks) within this 800-metre radius, land value is no longer measured solely by a single dwelling’s value, but by its development yield potential. This creates two distinct markets: standard residential sales, and adjacent sites that now hold an instant premium for developers. Buyers need to identify if their target property is now a high-value, potential development site.

The Tactical Playbook

Tactical Advice for Buyers

- Exploit the RBA Plateau: The RBA’s cash rate sits at 3.60 percent. This period of stability has nudged borrowing capacity higher for many. Refresh your pre-approval immediately and run scenarios for both private treaty and auction to ensure instant readiness.

- Target Structural Value: Because renovated, turnkey homes are commanding huge premiums, look tactically at properties with good structural bones that require cosmetic renovation. The competition pool for these properties is thinner, allowing you to avoid the “immediacy tax.”

- Widen Your Net: If you are chasing a family home, and the competition in suburbs like Collaroy is too intense, shift focus to infrastructure-driven areas like Frenchs Forest where the price points are more accessible and the growth story is structural.

Tactical Advice for Vendors

- Prioritise Presentation to Achieve Velocity: If you want to achieve the rapid 12-day DOM average, presentation is paramount. Buyers want turnkey homes; professional styling and necessary pre-market repairs are no longer optional extras—they are investments that secure a premium price.

- Launch Now for Pre-Christmas Certainty: Leverage the current strong buyer sentiment and the need for settlement before the end of the year. Delaying until mid-October risks missing this critical window.

- Master the Pre-Auction Offer: Do not view a strong pre-auction offer as leaving money on the table. In a high-clearance market, the best tactical move is often accepting an unconditional offer that provides certainty and maximum price now, rather than risking auction volatility.

The Northern Beaches market is not slowing down. The velocity is high, buyer intent is proven, and structural supply issues are maintaining pressure. Success hinges on understanding these ground-level metrics and deploying a strategy built on data, not hope.