When it comes to Northern Beaches property market trends, not all suburbs are created equal. Our region is a patchwork of diverse pockets – from bustling town centres to secluded beachside enclaves – and each will experience the coming 18 months a little differently. In this blog, we’ll identify which Northern Beaches suburbs are poised to outperform (leading the pack in price growth through 2025–2026) and which may underperform (lagging behind the regional average).

More importantly, we’ll explain why – digging into the local drivers, plans, and risks that set each area apart. In true Sarah Kaye & Co. fashion, expect a fearlessly honest, data-fuelled analysis complete with clear reasoning (and a warm, approachable tone). Consider this your insider’s guide to the Northern Beaches real estate outlook, suburb by suburb.

How We Identify Future Leaders and Laggards

First, a quick note on methodology. Our outlook is grounded in both hard data and on-the-ground insight. We’ve combed through recent sales trends, rental yields, development plans, and our own proprietary forecasting (the same detailed analysis we share with clients). We ask: Which suburbs have tailwinds (new infrastructure, rising demand) that could fuel above-average growth? And conversely, which face headwinds (oversupply, environmental risks, affordability limits) that might restrain values?

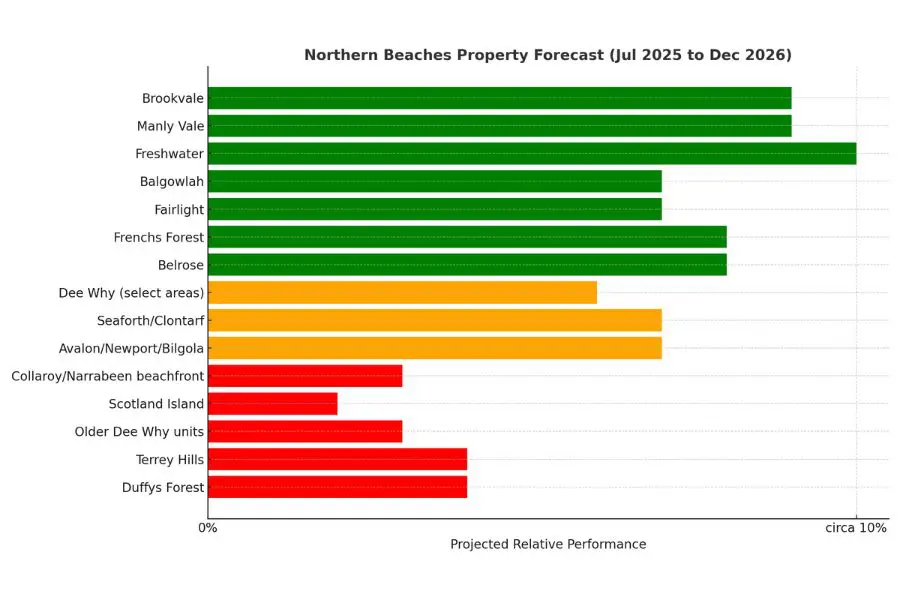

It’s important to state: even the “underperforming” suburbs aren’t destined for price drops – in fact, we expect most Northern Beaches suburbs to see moderate growth over the next 18 months. Underperforming in this context just means growing less or more erratically compared to the regional average. Likewise, an outperformer might only be ahead by a few percentage points, but in dollar terms, that can be significant. We’ll focus on relative differences.

To keep things concise, we’ll highlight a handful of suburbs in each category (with honourable mentions along the way). Even if your suburb isn’t named explicitly, the underlying trends we describe will likely apply. Now, let’s dive into the Northern Beaches property market trends, suburb by suburb.

Likely Outperformers: The Growth Leaders (2025–2026)

Several Northern Beaches suburbs stand out as likely growth leaders in the near term. These areas share some common traits: they’re either benefiting from new infrastructure/planning, enjoying spillover demand from pricier neighbours, or they offer a lifestyle/location combo that today’s buyers are willing to pay a premium for. Here are the top contenders:

Brookvale and Manly Vale – “B-Line” Unit Boomtowns

Brookvale and adjacent Manly Vale are primed for outperformance, especially in the apartment market. They sit along the B-Line rapid bus route and are core targets of the new Low & Mid-Rise Housing (LMRH) policy, which upzones areas near transport and town centres. Brookvale in particular is undergoing a transformation: a new town square and 1,350 new homes are planned as part of the Brookvale Structure Plan. This policy-driven boost means buyers and investors are increasingly eyeing Brookvale/Manly Vale for its future growth story.

We expect above-average price gains for quality units here (think modern boutique apartments or well-renovated older ones). These suburbs offer relative affordability plus upside – a potent combination. In fact, we’ve tagged Brookvale and Manly Vale among the top unit performers, anticipating high-single-digit to low-double-digit growth over 18 months (versus mid-single-digit regionally).

Freshwater, Queenscliff, and North Manly – Beach Proximity & Scarcity

On the more premium side, Freshwater and its neighbours, Queenscliff and North Manly, should continue to shine. These areas have a blue-chip beach lifestyle without the Manly price tag. Tightly held houses and semis in Freshwater routinely see fierce competition. Even units in these suburbs (often older walk-ups with character) tend to outperform because of their irreplaceable locations. During the recent slowdown, we observed that well-renovated homes in Freshwater still achieved record prices – a sign of resilience.

With interest rates easing, expect A-grade homes near the beach to set new benchmarks. Scarcity is a big factor: there are only so many properties within walking distance to Freshie beach, and demand far outstrips supply. These suburbs are likely to slightly outperform the overall Northern Beaches trend, especially for detached dwellings (we project something like ~10% total growth vs. ~6–8% regionally through the end of 2026, based on our models).

Balgowlah and Fairlight – Steady Performers with Upside

Bordering Manly, Balgowlah (including North Balgowlah) and Fairlight should see solid growth, potentially a notch above the rest. They are already expensive, established markets, but what pushes them into “leader” status is their mix of housing types and upcoming amenity improvements. Balgowlah is benefitting from the planned Stockland Balgowlah redevelopment (think new retail and community spaces) and is also touched by LMRH zoning around the village. This means new boutique apartments over time and a general uplift in walkability.

Fairlight, on the other hand, rides on Manly’s coattails – offering harbour views and prestige houses that will hold value and climb as high-end buyers grow more confident. These areas won’t see explosive growth (they’re too mature for that), but expect them to exceed the average thanks to the scarce supply of family homes and consistent demand. (As one indicator, Fairlight’s median house price has already crept back near its peak, faster than some other suburbs.)

Frenchs Forest & Belrose – The New Place-to-Be (Eventually)

It might seem counterintuitive to label Frenchs Forest (and nearby Belrose) as “outperformers” given the massive development planned there – usually lots of new supply dampens prices. However, over our 18-month horizon, limited new stock will actually hit the market. What will happen is an amenity surge: the new Northern Beaches Hospital is open, and a town centre with thousands of homes is on the way. As that vision takes shape, buyer sentiment is shifting. Young families who previously hadn’t considered the Forest are now thinking: “Hey, in a few years this area will have a vibrant centre, cafés, parks – let’s get in now.”

We anticipate above-average growth for houses in Frenchs Forest, especially as people buy the story (and enjoy larger blocks for the money). Early signs: auction clearance rates in the Forest have been notably strong recently. Do note, the ride could be bumpy – construction phases may create some short-term noise and traffic – but overall, we’re bullish on the Forest’s trajectory through 2026 and beyond.

Other Honourable Mentions

Other honourable mentions on the likely outperform list: Dee Why (certain pockets, particularly for units near the town centre, will benefit from investor demand and improvements in public space), Seaforth/Clontarf (ultra-premium enclaves where scarcity of listings means any uptick in demand pushes prices up sharply), and the “Lifestyle North” suburbs of Avalon, Newport, and Bilgola Plateau (these benefited from a COVID boom and dipped, but are now seeing a resurgence of tree-change buyers and remain highly desirable for their village feel).

In short, our growth leaders are either connectivity hubs (transit-linked, densification areas) or scarcity markets (prestige or beachside with limited turnover). Now, let’s talk about the flip side – the spots that may not keep up with the pack.

Potential Underperformers: Areas to Watch with Caution

No Northern Beaches suburb is truly “bad” – this is an upscale region overall – but some pockets face challenges that could make their growth slower and more uneven. If you’re buying or owning in these areas, it doesn’t mean doom and gloom, just that you should set expectations accordingly and exercise extra due diligence. Here are the key ones:

Coastal Risk Zones (Collaroy/Narrabeen beachfront)

Beautiful as they are, the low-lying beachfront strips in Collaroy and Narrabeen come with a double-edged sword. On one hand, these properties have stunning ocean views, and buyers do pay a premium for that lifestyle. On the other hand, insurance costs and climate risks(coastal erosion and flooding) are very real concerns here. Over the next 18 months, we expect these risk factors to be increasingly priced in. Lenders and insurers have become more cautious on these addresses.

In a strong market, A-grade beachfront homes will still sell strongly (there will always be someone willing to take the gamble for a slice of paradise). But if the market only modestly rises, these properties might underperform the Northern Beaches average – e.g. growing a couple of per cent instead of, say, 5%+. Buyers are more discerning, often negotiating discounts to offset the long-term costs of mitigation (seawalls, etc.). If sentiment turns “risk-off” at any point (say after a storm event or negative media on climate), expect price dips or prolonged days-on-market for these homes. Long-run owners have adapted and usually hold through such phases, but as an investor or new buyer, go in with eyes wide open and budget for those extra holding costs.

Scotland Island & Offshore Pockets

The ultra-unique boat-access communities like Scotland Island (and the offshore homes in Pittwater reachable only by water) are likely to lag simply due to their niche nature. These markets have thin liquidity and a very specific buyer pool. In hot markets, they can spike (people romanticise the idea of an island home), but in normal times, they trade irregularly.

Over the next 18 months, with the market in a steady (but not frenetic) state, we anticipate Scotland Island values to remain relatively stable overall. The logistics of living there (water access, limited infrastructure) mean it’s not on most buyers’ radar. If broader demand is strong, mainstream suburbs will see multiple bidders and rising prices – whereas an offshore property might still struggle to find one perfect-fit buyer. We actually rate these properties as wonderful lifestyle buys if it suits you, but from a pure market perspective, expect underperformance relative to the broader Northern Beaches.

Older High-Density Unit Blocks in Dee Why & Narrabeen

Earlier, we praised Dee Why for certain segments (newer units near the centre). The flip side is that older high-density blocks – particularly those 1970s/80s walk-ups or tired high-rises without modern amenities – could lag. Why? As more new or freshly renovated units come on the market (in Dee Why, Brookvale, Narrabeen, etc.), buyers and renters naturally gravitate to those. Older blocks with no lifts, no air-con, or looming special levies will need to stay price-attractive to compete.

We foresee a wider quality-based dispersion in unit prices. For example, two-bedroom units in Dee Why could range from underperforming older stock that barely moves in value, to well-located refurbished ones that jump 8%. If you own one of these older blocks, consider value-adding (even small updates) to keep your unit competitive. And if you’re buying, do thorough due diligence on strata health – a building with a poor maintenance record might see values stagnate or even dip if big repair bills surface (whereas the general unit market is rising). Essentially, stock selection within these suburbs is crucial; the average may underperform because the laggards drag down the mean.

Terrey Hills & Duffys Forest – Acreage Market Realities

In the leafy far-western edge of the Beaches, Terrey Hills and Duffys Forest offer acreage and semi-rural vibes. These properties are fabulous for space and privacy, but they are more sensitive to the broader economy. Two factors at play: one, they attract a smaller subset of buyers (those wanting large land and okay with a longer commute), and two, they are high-priced luxuries that depend on confident, often high-income buyers. In a rising tide, they do fine, but in a lukewarm market, they can underperform simply because their pool of buyers is limited.

We also note that these areas are more impacted by interest rate swings (since buyers often need big loans for multi-million-dollar acreages) and by bushfire risk (which, like coastal risk, adds a layer of caution). Over the next 18 months, we expect Terrey Hills/Duffys to see low-single-digit growth at best. Sales will likely be lumpy – a few big sales might spike the median, then quiet periods follow. If you’re selling here, be prepared for longer listing times. If you’re buying, you might find more negotiating power than in, say, Frenches Forest or Mona Vale. These suburbs aren’t in trouble by any means, but relative to, say, a Brookvale or Freshwater, we put them in the slower lane for now.

To sum up the underperformers: they’re the niches with either unique challenges (offshore access, climate risk) or lessened demand pressure (less central, or overshadowed by newer alternatives). They might still grow, but likely not as fast as the Northern Beaches norm.

Putting It All Together: Navigating the Northern Beaches Market

A Nuanced Market

The Northern Beaches is entering a new mini-cycle, and nuance is key. Broadly, the property market trends here point to moderate growth, but as we’ve detailed, some suburbs are positioned to do a bit better (or worse) than others. If you’re a buyer, this means opportunity: targeting the right area can yield above-market returns, if it aligns with your lifestyle needs. For instance, if you’re debating between two suburbs, knowing that one has a catalyst (say, a new town centre or transport link) could sway your choice. As always, balance that with personal fit – there’s no point in chasing an “outperformer” suburb if you won’t love living there.

Micro Trends

For homeowners and investors, understanding these micro-trends helps set realistic expectations. Maybe your property is in a likely outperformer suburb – that’s great, but don’t get carried away; use it as an advantage (e.g., consider selling during the upswing if it aligns with your goals). If your property is in a potential underperformer area, focus on what you can control: property presentation, maintenance, and smart marketing when selling can still achieve strong results even in tougher pockets. And remember, real estate is a long game. Short-term underperformance can flip to outperformance in the next cycle (for example, those risk-zone beachfronts often roar back when the market is hot).

Due Diligence

In all cases, due diligence and expert advice matter. We’ve laced this analysis with data and a “boots on the ground” perspective because, as trusted Northern Beaches Buyers Agents, we believe in sharing the why, not just the what. If you have questions about a specific suburb not mentioned, or want to drill deeper into your street, we’re here to help with clear, honest insight. We hope this overview of Northern Beaches outperformers vs. underperformers over the next 18 months gives you clarity and confidence as you plan your moves in the market.

No hype – just facts, transparency, and a bit of educated conjecture thrown in. After all, we promised to “call it as we see it”, and we’ll continue to do exactly that as your local property advisors. Happy home hunting (or home holding), and may your suburb shine in 2025 and beyond!