As experienced Northern Beaches Buyers Agents, we can tell you that buying a property without a buyers agent IS absolutely possible — but let’s be fearlessly honest: it is one of the hardest DIY challenges in Australian real estate. The Northern Beaches is not a “normal” market. It’s a tightly held coastal region defined by generational scarcity, fierce competition, and buyers who rarely take a day off.

From Manly to Mona Vale, and Freshwater to Forestville, the same patterns repeat: low stock, high demand, and prices that keep rising because people don’t just want to live here — they compete to live here.

If you’re committed to buying a Northern Beaches property without a buyers agent, this guide gives you a clear, disciplined roadmap. No fluff. No jargon. No hidden agendas. Just the truth buyers deserve.

Why the Northern Beaches Market Is Different

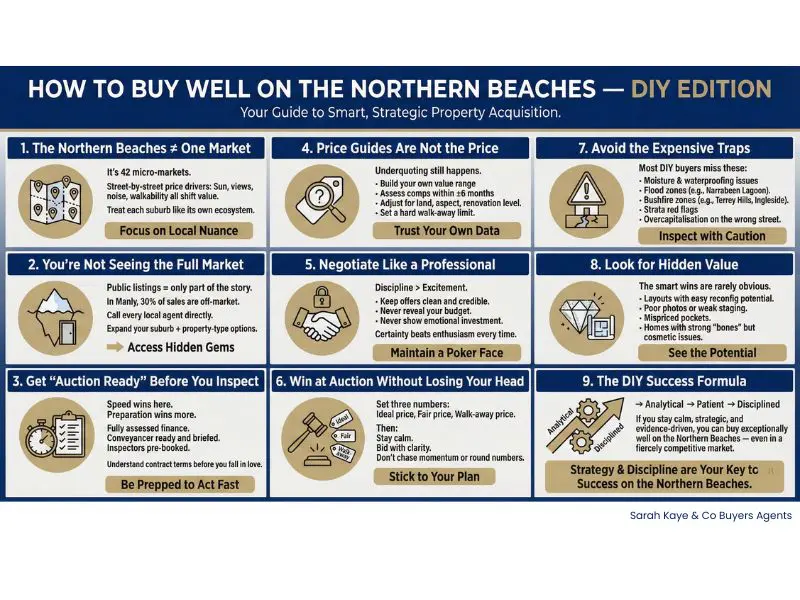

The Northern Beaches isn’t a single market. It’s 42 micro-markets, each with its own pricing patterns, buyer depth, and local quirks.

A unit in Dee Why behaves nothing like a house in Manly. A townhouse in Warriewood attracts a completely different buyer group to one in Fairlight.

Why buying here is uniquely challenging:

Chronic undersupply

- Most suburbs are fully built out.

- Streets rarely turn over.

- Many prestige homes pass through generations.

Demand that never cools

- Beaches, safety, schools, lifestyle

- Even in slow cycles, multiple buyers compete.

Off-market distortion

- In some pockets like Manly, up to 40% of homes sell quietly.

- Buyers relying only on portals see “half the market.”

Micro-location value swings

- The sunny side of a street can be worth $300k more.

- Noise, slope, access, views = major value shifts.

If you want to succeed, you must treat the region as a mosaic — not a monolith.

Build a Search Strategy That Finds What Google Can’t

Relying solely on Realestate.com.au or Domain alerts will guarantee you miss opportunities. The first rule of buying a Northern Beaches property without a buyers agent is this:

The real market is bigger than the visible market. Here’s how to find more than the average DIY buyer:

Be proactive with selling agents

Agents are the gatekeepers of off-market and pre-market listings.

Your job:

- Contact every Northern Beaches sales agent.

- Be specific about what you want.

- Follow up weekly.

- Build relationships that keep you front-of-mind.

Your goal:

Become the buyer they call before they upload a listing.

Widen your suburb lens

Most buyers search too narrowly.

Examples:

- Love Freshwater? Try North Curl Curl or Queenscliff.

- Want Manly lifestyle? Consider Balgowlah, Fairlight, Manly Vale.

- Need value and space? Look at Beacon Hill, Cromer, Elanora Heights.

Your “Plan B suburbs” may deliver 90% of the lifestyle for 20–30% less.

Think lifestyle, not stereotypes

Most buyers say they want:

- A house

- Near the beach

- Three bedrooms

- Level land

Then they see the price.

The smarter question is:

What lifestyle outcome am I actually trying to achieve?

Sometimes, a top-floor unit with ocean breezes, parking, and storage is a superior lifestyle to a dark townhouse with no aspect.

DIY buyers who win are flexible buyers.

Become Competition-Ready Before the First Inspection

The biggest mistake DIY buyers make is doing tasks in sequence. Professionals run everything in parallel.

If you wait to:

- Confirm your borrowing

- Line up a conveyancer

- Secure an inspector

- Review a contract

- Check comparable sales

…you’ll lose repeatedly.

How to get competition-ready:

Lock down finance

Ask your broker for:

- A fully assessed pre-approval

- A clear upper limit

- Scenarios including renovations, strata fees, or rising rates

Reality check:

Pre-approval ≠ ready to buy.

Line up your conveyancer now

Choose someone who:

- Turns contracts around fast (it’s no good having an expensive Solicitor if they turn off their phones at 5 pm on a Friday… we generally use a trusted Conveyancer!)

- Understands Northern Beaches issues

- Gives direct, tough guidance — not vague reassurance

Book your inspectors in advance

Good inspectors book out days ahead.

You need relationships that let you move within hours.

Understand NSW buying law

- Gazumping is legal.

- Verbal agreements mean nothing.

- You only own the property when contracts exchange.

This one rule changes everything.

Master the Pricing Game (Where Most DIY Buyers Lose)

Underquoting still happens — even with tougher laws. The selling agent’s loyalty is always to the vendor, not you.

This means:

- Price guides can mislead

- Reserves are hidden

- Comparables are selectively chosen

- Emotional buyers overpay regularly

To protect yourself, build your own independent pricing model.

How to price a property yourself:

Study comps

- Within ±6 months

- Within ±1km

- Similar land, aspect, layout, and renovation level

Analyse what didn’t sell

Unsold properties reveal price ceilings and red flags.

Score the property (1–10)

Be brutally honest about strengths and weaknesses.

Set your walk-away number

- Write it down.

- Stick to it.

- Never adjust because “the market feels hot.”

Pricing discipline is what saves buyers from regret.

Win Private Treaty Negotiations

Most DIY buyers reveal too much, too early.

Rules that matter:

- Never reveal your maximum budget

- Never show excitement

- Never assume you’re the only buyer

- Never depend on “first in best dressed”

- Never trust an unexchanged agreement

A clean, credible offer beats a high offer.

Elements of a strong offer:

- Signed contract

- Section 66W (if due diligence completed)

- Clear settlement terms

- Proof of funds

- Minimal conditions

Agents and vendors choose certainty over enthusiasm.

Bidding at Auction Without Losing Your Head

Auctions are engineered to create panic, urgency and FOMO.

Auction prep checklist:

- Watch several auctions from the same agency

- Speak with the auctioneer

- Understand the campaign strategy

- Set three numbers:

- Ideal price

- Fair price

- Walk-away price

During the auction:

- Stay calm

- Bid with clarity

- Don’t chase momentum

- Don’t round numbers

- Don’t bid in “dead space”

Your goal isn’t to “win.”

Your goal is to buy at the right price.

Avoid the Expensive DIY Traps

The Northern Beaches has unique risks. A missed issue can cost hundreds of thousands.

The big ones:

1. Moisture and waterproofing

Common in older units (Manly, Freshwater, Narrabeen).

2. Bushfire zones

Duffys Forest, Ingleside, Terrey Hills, parts of Elanora Heights.

3. Flood risk

Narrabeen Lagoon, Collaroy Basin, low-lying lake-adjacent streets.

4. Strata financial risks

Low sinking funds, upcoming special levies, concrete spalling.

5. Overcapitalisation

A perfect home on the wrong street can still be a bad investment.Due diligence isn’t optional.

It’s essential.

Spot Hidden Value Like a Pro

Smart DIY buyers win by seeing what others overlook.

Look for:

- Layouts with cheap reconfiguration potential

- Poorly photographed listings

- Homes with “good bones” but cosmetic issues

- Northerly light opportunities

- Undervalued micro-pockets

- Homes misrepresented online

“Value” often hides in the fine details.

Final Word: DIY Is Possible — But Only With Discipline

Buying a Northern Beaches property without a buyers agent requires:

- Structure

- Preparation

- Calm judgment

- Evidence

- Discipline

You can buy well without professional help — but only if you avoid emotional decisions, stay analytical, and follow a process that keeps you sharp, prepared, and clear-headed.

If you do that, you’ll secure a great home on your own terms — and with full confidence you earned every part of the result.

Good luck! Sarah Kaye & Co Buyers Agents.