Upper North Shore Property Market Report Jan 26: Heritage Estates Meet Strategic Opportunity

Market Overview: The Upper North Shore Landscape

The Upper North Shore represents one of Sydney’s most enduring property markets, characterised by heritage estates, leafy streetscapes, and institutional educational infrastructure. This corridor has historically demonstrated remarkable price resilience, driven by intergenerational wealth transfer, established family demographics, and proximity to elite private schools. However, Q4 2025 data reveals a market experiencing measured recalibration rather than uniform growth.

For buyers seeking strategic acquisition opportunities, understanding these nuanced dynamics proves essential. The Upper North Shore is not a monolithic market. Rather, it comprises distinct tiers—from ultra-premium heritage estates commanding $4M+ medians to transit-oriented suburban pockets offering sub-$2.5M entry points. Each tier operates with different buyer motivations, price sensitivities, and growth trajectories.

As an Upper North Shore buyers agent, our analysis of the latest quarterly data shows divergent performance across dwelling types and suburbs. Notably, house prices across most suburbs experienced negative quarterly growth, while select unit markets demonstrated resilience and even modest appreciation. This inverse relationship between houses and units signals a potential structural shift in buyer preference—one that strategic buyers must understand to execute successful acquisitions.

The current environment presents a compelling opportunity for discerning buyers with access to sophisticated market intelligence, pre-approved finance, and capacity to negotiate with institutional rigour. However, success demands more than capital. It requires deep understanding of school catchment premiums, infrastructure connectivity, demographic evolution, and the subtle distinctions that separate blue-chip streets from merely aspirational addresses.

Quarterly Growth Analysis: Houses vs Units

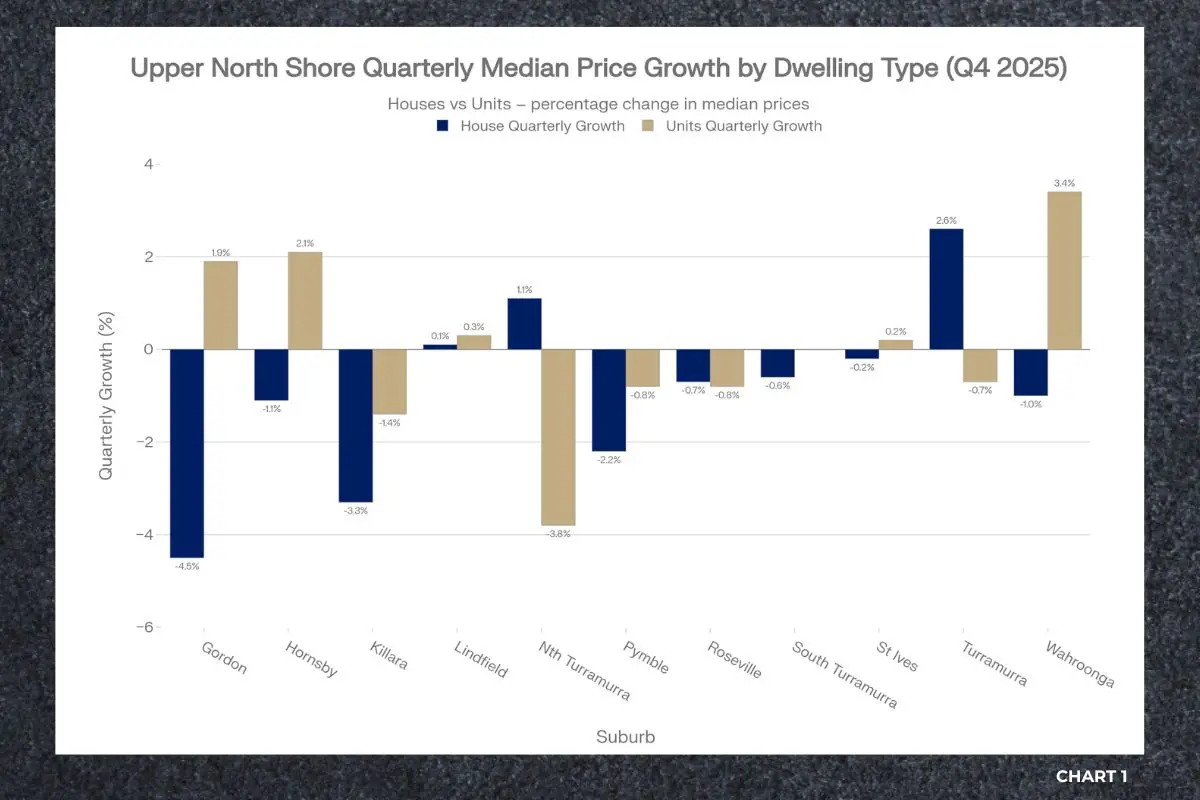

The most significant finding from Q4 2025 data centres on the contrasting performance between houses and units. Across the Upper North Shore, house prices generally softened, with several prestigious suburbs recording notable quarterly declines that exceeded broader Sydney trends. Conversely, unit markets showed greater stability and, in specific locations, modest growth.

Chart 1 illustrates this divergence with exceptional clarity. Gordon recorded the steepest house price decline at -4.5%, a significant correction for a train-line suburb with strong infrastructure connectivity. This suggests that even traditionally resilient locations are not immune to broader interest rate pressures and buyer hesitancy.

Hornsby followed with a -1.1% decline for houses, while Killara—one of the Upper North Shore’s most prestigious addresses—recorded -3.3% quarterly softening. Pymble declined -2.2%, Roseville fell -0.7%, and St Ives dropped -0.2%. This widespread softening across the house market indicates that buyers are exercising greater caution, likely driven by elevated entry prices, interest rate uncertainty, and reduced urgency in a slowing market.

Meanwhile, unit prices demonstrated remarkable resilience. Gordon units rose 1.9% despite house price declines in the same suburb. Hornsby units increased 2.1%, and Wahroonga units climbed an impressive 3.4%. Lindfield units gained 0.3%, while Killara units declined only -1.4%—a far more modest correction than the -3.3% experienced by houses in the same suburb.

This inverse relationship suggests several potential drivers. First, downsizers—a significant demographic cohort in the Upper North Shore—may be actively seeking lower-maintenance alternatives to large family homes. Second, first-home buyers and young professionals, priced out of detached housing, are concentrating demand in the unit segment. Third, interest rate sensitivity impacts larger mortgages more significantly, creating disproportionate pressure on house prices while leaving unit prices relatively insulated.

Turramurra emerged as the notable outlier, recording positive quarterly growth of 2.6% for houses while units declined -0.7%. This exceptional performance likely reflects the suburb’s unique positioning: direct train line connectivity to the CBD, large garden blocks that appeal to families prioritising space, and a village atmosphere with strong local amenity. Turramurra demonstrates that even in a softening market, suburbs with differentiated value propositions can sustain positive momentum.

South Turramurra houses declined -0.6%, while North Turramurra recorded 1.1% growth—suggesting that even within the same geographic area, micromarket dynamics can diverge based on specific street character, topography, and school catchment boundaries.

Premium Positioning: Median House Price Hierarchy

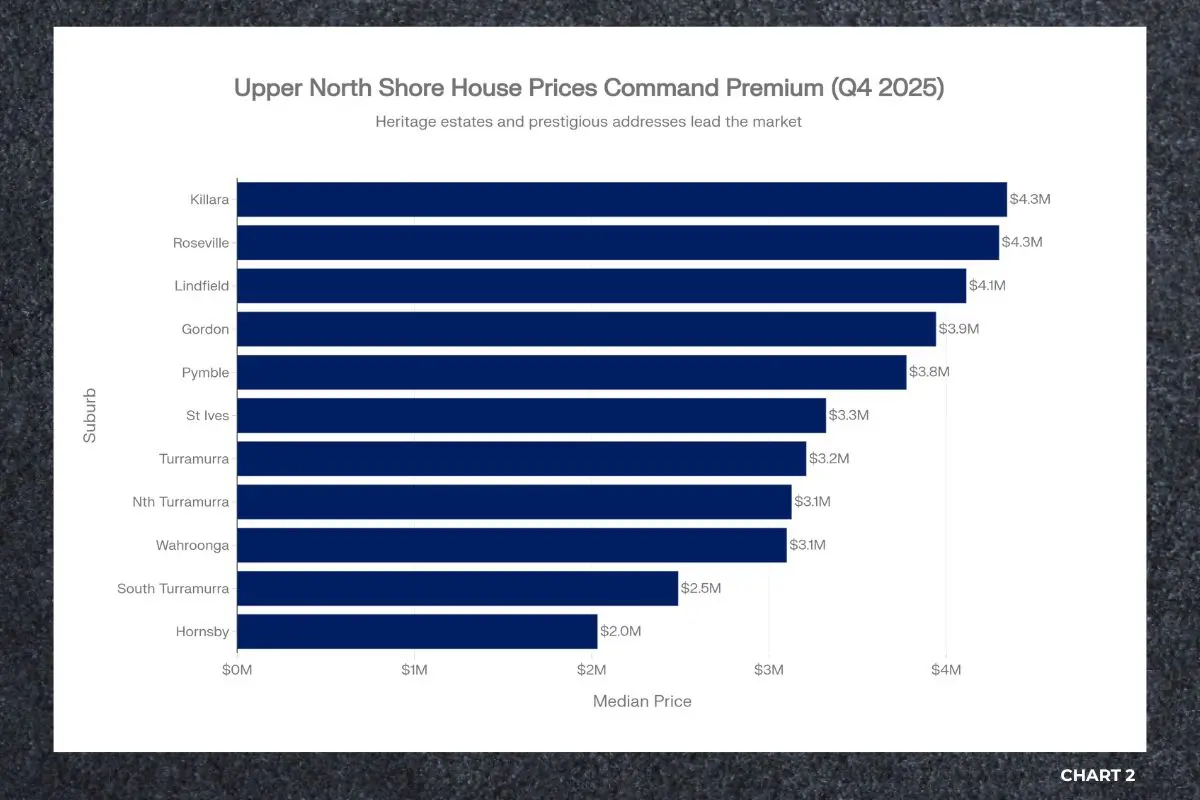

Despite a quarterly softening, the Upper North Shore remains one of Sydney’s premier residential corridors. Median house prices range from approximately $2.0M in Hornsby to $4.3M in Killara, with most suburbs clustering between $3.0M and $4.2M. This price hierarchy reflects decades of institutional buyer behaviour, educational infrastructure investment, and land scarcity.

Chart 2 demonstrates the clear stratification. Killara commands the highest median at $4.3M, reflecting its designation as “The Garden Suburb”—a heritage-protected enclave characterised by exceptionally large blocks, mature landscaping, and proximity to Ravenswood School for Girls. Killara’s price premium is structural, not speculative. It represents one of the Upper North Shore’s most tightly held markets, where properties rarely change hands outside family succession planning.

Roseville follows at $4.3M, sharing similar characteristics: train line connectivity, large blocks, and proximity to Roseville College. Pymble registers $3.8M median, positioned as a blue-chip family suburb with substantial land holdings and superior private school access including Pymble Ladies’ College. These three suburbs represent the Upper North Shore’s institutional core—locations where demand from established families with intergenerational wealth ensures price resilience across market cycles.

Lindfield ($4.1M) and Gordon ($3.9M) occupy the upper-premium tier while offering superior infrastructure connectivity. Both suburbs benefit from direct train line access, established cafe culture, and large blocks within walking distance of stations—a rare combination that appeals to professional families unwilling to sacrifice connectivity for space.

St Ives ($3.3M) and Turramurra ($3.2M) sit in the mid-premium segment. St Ives offers north shore affluence without the train line, appealing to buyers prioritising larger blocks and bush interface over public transport. Turramurra delivers the opposite: train connectivity, village amenity, and established gardens.

North Turramurra ($3.1M) and Wahroonga ($3.1M) provide substantial land holdings at slightly lower price points, particularly appealing to buyers executing long-term family strategies where educational infrastructure and community stability justify the investment.

At the more accessible end, Hornsby presents a compelling value proposition at approximately $2.0M median. As a major transit hub with Westfield shopping dominance, high-rise towers, and direct metro access, Hornsby offers a fundamentally different lifestyle proposition. This is not a heritage estate suburb—it is a high-density, transit-oriented development zone. For strategic buyers willing to accept apartment living or smaller blocks in exchange for superior infrastructure and sub-$2.5M entry, Hornsby represents efficient access to the Upper North Shore corridor with 45-minute CBD connectivity.

South Turramurra ($2.5M) offers a middle ground: quieter residential pockets with bush settings, soccer fields, and proximity to Turramurra High School, without the premium pricing of Turramurra village proper.

Unit Market Dynamics: Configuration-Based Premiums

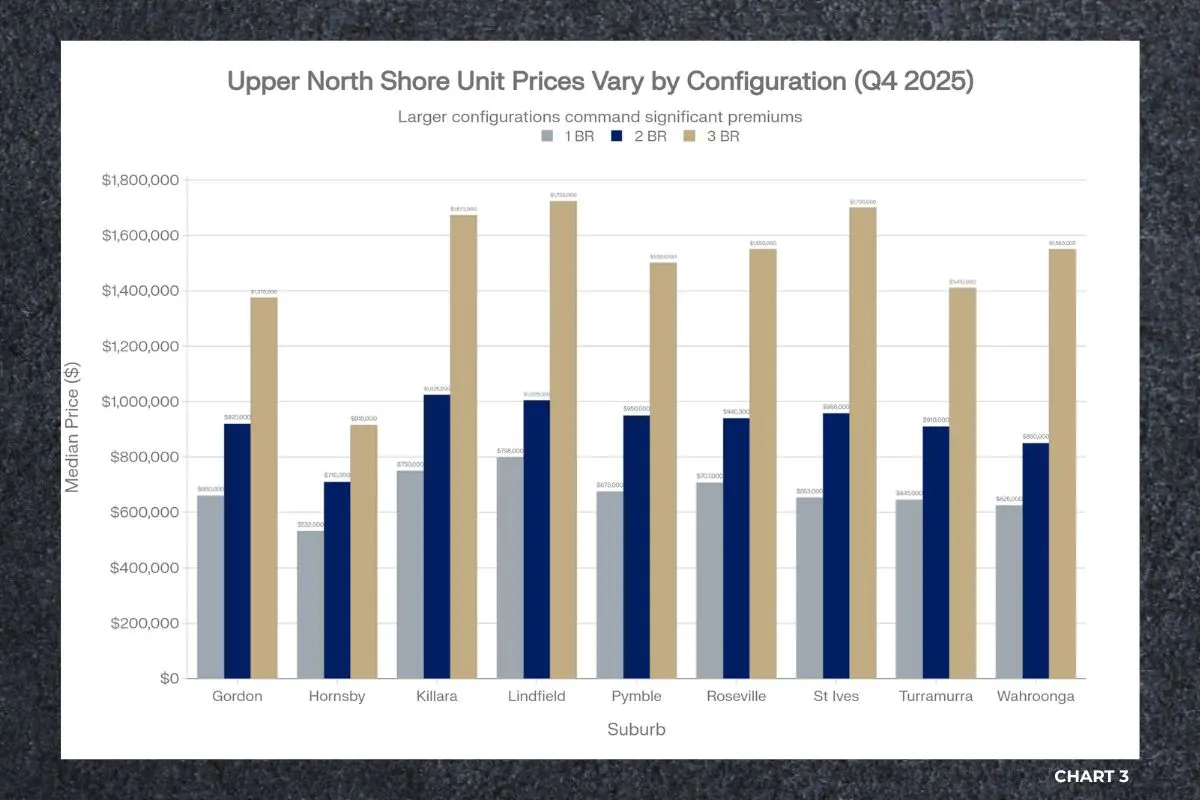

The Upper North Shore unit market demonstrates significant price variation based on bedroom configuration, location, and building quality.

Chart 3 reveals that three-bedroom units command substantial premiums over two-bedroom equivalents—a pattern driven by family buyers and downsizers seeking lower-maintenance alternatives to detached houses without sacrificing space.

In Gordon, three-bedroom units reach approximately $1.4M compared to $920,000 for two-bedroom configurations—a 52% premium. This significant differential reflects the scarcity of three-bedroom stock in the Upper North Shore, where apartment development historically focused on investor-oriented one and two-bedroom configurations. Families and downsizers seeking the convenience of apartment living but requiring guest rooms, home offices, or accommodation for adult children are willing to pay substantial premiums for that third bedroom.

Lindfield shows similar dynamics, with three-bedroom units around $1.7M versus approximately $1.0M for two-bedroom stock—a 70% premium. This exceptional premium reflects Lindfield’s positioning as a leafy, cafe-culture suburb on the train line where three-bedroom apartments remain exceptionally rare.

Hornsby presents the most affordable unit market across all configurations, with two-bedroom units from approximately $710,000 and three-bedroom options around $915,000. This pricing reflects the suburb’s higher density and transit-oriented development model. Hornsby has actively embraced vertical living with numerous high-rise towers surrounding the station precinct. For downsizers seeking strategic right-sizing without geographic relocation from the Upper North Shore corridor, Hornsby offers compelling value—particularly for buyers prioritising walkability, shopping convenience, and direct train access over suburban streetscapes.

Pymble demonstrates balanced pricing with two-bedroom units around $950,000 and three-bedroom configurations at $1.5M. However, Pymble’s unit market remains thin, with limited stock and sporadic transaction activity. Most development in Pymble consists of low-rise, boutique buildings rather than high-density towers, preserving the suburb’s established character while providing limited apartment options.

Killara and Roseville unit markets are similarly constrained, reflecting the predominance of detached housing in these blue-chip suburbs where council planning provisions historically restricted higher-density development to preserve heritage streetscapes and established garden character. This scarcity creates supply constraints that support pricing, but also limits options for buyers seeking apartment living in these prestigious locations.

Wahroonga shows strong pricing for two-bedroom units around $850,000 and three-bedroom configurations at $1.5M, reflecting the suburb’s appeal to downsizers seeking proximity to private schools while reducing maintenance responsibilities.

The consistent theme across all Upper North Shore unit markets is the premium commanded by three-bedroom configurations.

For strategic buyers, this suggests several considerations. First, three-bedroom units may offer superior capital preservation during market softening due to structural scarcity. Second, downsizers should budget significantly higher for three-bedroom stock if maintaining space for family visits remains a priority. Third, investors should recognise that while two-bedroom units offer lower entry prices, three-bedroom stock attracts owner-occupier demand, potentially delivering greater price stability.

Infrastructure and Connectivity: The Train Line Premium

One of the most significant determinants of Upper North Shore pricing and growth trajectory is proximity to the train line. Suburbs with direct station access—Gordon, Lindfield, Turramurra, Wahroonga, Hornsby—demonstrate pricing efficiency and sustained demand relative to their non-train counterparts.

The North Shore train line provides approximately 30-45 minute CBD connectivity, a critical advantage for professional families and executives requiring regular office attendance. Moreover, train access provides independence for teenagers attending city-based schools or weekend activities, reducing parental chauffeuring responsibilities—a significant lifestyle consideration for time-poor families.

Suburbs without train access—St Ives, Pymble (requiring bus feeder), North Turramurra, South Turramurra—must compensate with other attributes: larger blocks, superior school catchments, or lower pricing. This creates distinct buyer segments: those prioritising connectivity over space, and those prioritising land size and privacy over public transport.

For strategic buyers, this infrastructure differential presents opportunity. If work-from-home arrangements or retirement status eliminate commuting requirements, non-train suburbs offer superior value on a dollar-per-sqm-of-land basis. Conversely, if CBD connectivity remains essential, paying the train line premium delivers tangible lifestyle benefit and potentially superior resale liquidity.

The Sydney Metro extension will further reshape this dynamic, potentially elevating suburbs with future metro access while leaving others relatively disadvantaged. Strategic buyers should consider not merely current infrastructure, but planned enhancements that may impact long-term value trajectories.

School Catchment Premiums: The Educational Infrastructure Advantage

The Upper North Shore’s price hierarchy cannot be understood without recognising the foundational role of educational infrastructure. This corridor hosts some of Australia’s most prestigious private schools—Ravenswood, Pymble Ladies’ College, Knox Grammar, Barker College, Abbotsleigh, St Lucy’s—alongside sought-after selective public schools.

Suburbs proximate to elite private schools maintain institutional demand regardless of quarterly volatility. Families executing 10-15 year educational strategies—purchasing homes when children are young to secure proximity for eventual enrolment—create structural demand that transcends interest rate cycles and economic uncertainty.

Killara’s premium pricing reflects immediate proximity to Ravenswood and Killara High School (a sought-after comprehensive public school). Pymble’s $3.8M median is similarly supported by proximity to Pymble Ladies’ College and multiple Catholic primary schools. Wahroonga commands premium pricing due to Knox Grammar, Abbotsleigh, and numerous other institutions concentrated in the suburb.

For strategic buyers, school catchment boundaries represent invisible but powerful price determinants. Properties located within a few streets of school catchments can command 10-20% premiums over otherwise identical properties just outside boundaries. Buyers with school-age children should engage an Upper North Shore buyers agent with detailed knowledge of catchment maps, planned boundary changes, and enrolment policies to ensure acquisitions serve long-term educational objectives.

Conversely, buyers without school-age children—retirees, empty nesters, young professionals—should actively avoid paying school catchment premiums for attributes they will never utilise. This represents a strategic arbitrage opportunity: purchasing in excellent suburbs just outside premium catchments to capture location benefits without paying educational infrastructure premiums.

Strategic Considerations for Buyers

As established Upper North Shore Buyers Agents, we see distinct opportunities for buyers operating with institutional rigour and strategic patience. Several key factors warrant careful consideration.

Timing Advantage

Negative quarterly growth across most house submarkets suggests reduced competition and improved negotiating leverage. In a rising market, buyers face multiple bidders, aggressive price expectations, and limited scope for due diligence. The current environment reverses these dynamics. Vendors face longer days-on-market, fewer inspections, and greater willingness to negotiate on price and contract terms. For buyers with pre-approved finance and flexible settlement timeframes, this environment enables surgical negotiation on premium assets that would have attracted fierce competition 12-18 months earlier.

Unit Market Resilience

The relative strength of unit prices—particularly three-bedroom configurations—indicates sustained demand from downsizers and family buyers seeking maintenance-minimised alternatives. This segment may offer superior capital preservation during broader market softening. Strategic buyers seeking defensive positioning should prioritise three-bedroom units in train-line suburbs with established amenity.

Infrastructure-Driven Value

Suburbs with superior transit infrastructure (Hornsby, Lindfield, Gordon) demonstrate pricing efficiency relative to heritage estates. Buyers prioritising connectivity over land size should focus acquisition efforts here. The arbitrage opportunity exists in purchasing high-quality apartments or smaller blocks in train-line suburbs at 25-40% discounts to heritage estate pricing while capturing superior lifestyle convenience.

School Catchment Premiums

Suburbs proximate to elite private schools (Killara, Pymble, Wahroonga) maintain institutional demand regardless of quarterly volatility. Families executing 10+ year educational strategies should prioritise these locations despite higher entry prices, as long-term value is underpinned by constrained supply and consistent generational demand.

Off-Market Opportunities

In softening markets, quality vendors often pursue private sales to avoid public auction exposure and maintain discretion. Engaging a principal-led Upper North Shore buyers agent with deep local networks provides access to this “silent market“—properties that never reach real estate portals but represent exceptional value for buyers with established relationships.

The Role of a Strategic Upper North Shore Buyers Agent

Navigating the Upper North Shore market requires more than familiarity with listings or attendance at open homes. It demands institutional-grade market intelligence, forensic due diligence, and surgical negotiation capability developed through decades of transaction experience.

As a principal-led Upper North Shore buyers agent, Sarah Kaye Co. provides sophisticated guidance calibrated to the unique dynamics of this corridor. Our approach combines quantitative analysis of quarterly growth trajectories with qualitative assessment of school catchments, infrastructure development timelines, and demographic evolution patterns. We operate as protective advocates, applying military-grade precision to every contract review, building inspection, and price negotiation.

Our distinct advantage lies in the combination of professional pedigree and real-world market expertise. Co-founder Mike brings strategic depth honed through advising global CEOs on complex investment decisions, while co-founder Sarah leverages extensive insider knowledge from years operating as a selling agent—understanding precisely how listing agents position properties, construct marketing campaigns, and negotiate with buyers. This “insider-outsider” advantage enables us to level the playing field, identifying agent tactics and protecting client interests with absolute transparency.

For discerning buyers seeking certainty in an uncertain market, engaging a strategic advisory firm with deep Upper North Shore expertise proves essential. We identify off-market opportunities through established networks before they reach public platforms. We conduct forensic due diligence on building reports, strata schemes, and contract terms—identifying hidden risks that inexperienced buyers overlook. We negotiate with institutional rigour, leveraging market data and comparable sales to secure optimal pricing and contract terms.

Most importantly, we provide honest, principled advice—including recommending clients walk away from unsuitable properties. Unlike selling agents incentivised to close transactions regardless of buyer interests, our fiduciary duty lies exclusively with our clients. This alignment of interests ensures every acquisition serves long-term capital objectives and lifestyle requirements.

Conclusion: Measured Opportunity in a Prestige Market

The Upper North Shore in 2026 represents a market in transition—softening house prices juxtaposed against resilient unit demand, with clear hierarchy separating heritage estates from transit-oriented suburbs. For strategic buyers armed with comprehensive market intelligence, pre-approved finance, and institutional-grade advisory support, this environment offers measured opportunity.

The current softening creates negotiating leverage absent during the 2020-2022 growth cycle. Vendors face realistic price expectations, greater willingness to negotiate, and extended marketing periods. However, this opportunity exists within a premium market characterised by long-term structural demand, constrained supply, and intergenerational wealth concentration.

Successful acquisition demands more than capital. It requires understanding of local micromarkets, relationships with selling agents enabling access to off-market opportunities, and capacity to execute with speed and precision when exceptional assets emerge. It requires distinguishing between temporary quarterly volatility and structural value deterioration. It requires forensic contract analysis, sophisticated building inspection interpretation, and strategic settlement timing.

This is where a qualified Upper North Shore buyers agent provides decisive advantage—transforming market complexity into strategic clarity. At Sarah Kaye Co., we provide the institutional rigour, professional pedigree, and protective advocacy that discerning buyers require when deploying significant capital in Sydney’s most prestigious northern corridor.